The high cost of missing the stock market’s best days

Discipline, not timing, is the key to financial returns

KEY POINTS

- Avoiding market volatility entirely often creates a different risk: failing to keep pace with inflation.

- Missing even a handful of the stock market’s best days can significantly reduce long term returns.

- Market rebounds frequently occur during downturns, making market timing extremely difficult.

Having a disciplined plan and sticking to it has been good advice for a long time. Understanding what level of risk one can tolerate is important in a world where risks are always present, and the ability to achieve longer-term financial goals is difficult without accepting some level of risk. In fact, one could say that avoiding one risk is the acceptance of another form of risk. For instance, investors can avoid the risk of stock market volatility, but doing so means accepting the risk that their portfolio might not keep pace with inflation. With all this in mind, prudent investing calls for an understanding of the risks involved and the ability to match those risks with the investor's goals, objectives, and risk tolerance.

Common stocks have proven to be an asset class with the ability to grow in excess of inflation, as the opportunity for “real” gains is high. However, historically, stocks have also been volatile in price. Crashes, recessions and depressions have all led to material declines in the value of stocks, sometimes lasting years in duration. For many investors, then it would seem that if they could just avoid the “downside” and only be invested in good times, then returns would be even better. Yet while true, knowing when the good days or bad days are coming is exceedingly difficult.

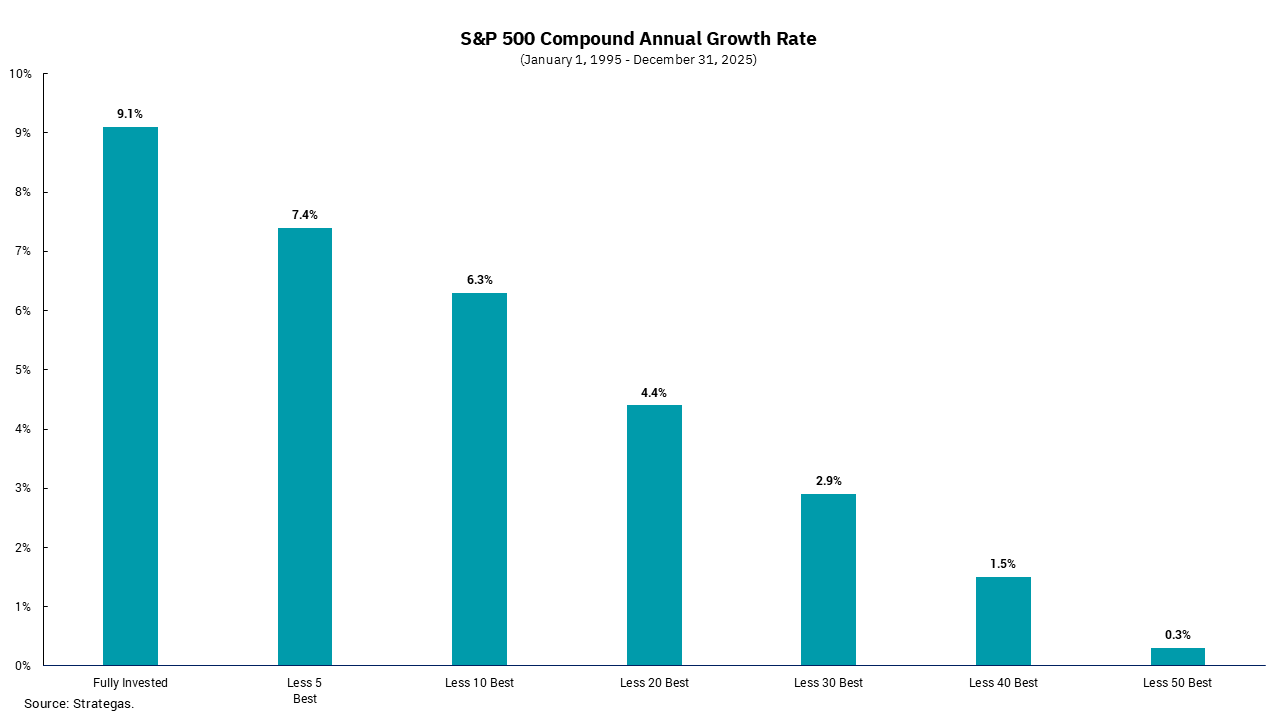

Our chart this week provides insight into how material it can be if an investor misses only a few of the good days in the market. For context, this data covers a 30-year period of time. If we assume there are roughly 220 trading days in a year (five days a week, minus a few holidays), then this 30-year period covers approximately 6,600 trading days. The compound annual growth rate over that 30-year time frame, if one were invested every day, is 9.1%. An investor missing the five best days over this period saw their return fall to 7.4%. All it took was missing 0.07% of all the trading days to reduce your return by 18.7%. Carried to the far right of the chart, missing the 50 best days, a mere 0.75% of all the days over 30 years, and an investor's return was basically 0%.

A review of the data reveals another interesting bit of information. Many of the “best” days over this 30-year period occurred amid a market downturn, further enforcing the idea of just how hard it can be to try to time the market. Staying disciplined is hard in more than investing. Yet always keeping risk management at the forefront of a process helps an investor weather the inevitable negative periods in a way in which they can stay in the game. We all want to make money, but understanding one’s investing process can help avoid poor decisions during periods of market stress and highly charged emotions. We remain committed to our diversified, risk-managed approach on behalf of our clients.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)