Can’t afford that unexpected car repair? You’re not alone.

Having an emergency fund can help you avoid piling on high-interest debt

A growing number of Americans can't afford an unexpected expense, as the personal savings rate continues to decline amid high inflation.

Slightly less than half (49%) of respondents to a May survey said they wouldn't be able to rely on their cash savings to cover a $400 emergency. That's a 17% increase from November, when just under one-third of respondents said they couldn't afford such an expense.

This rising number of Americans without adequate cash savings comes as prices continue to climb, including the cost of essentials like food and gas.

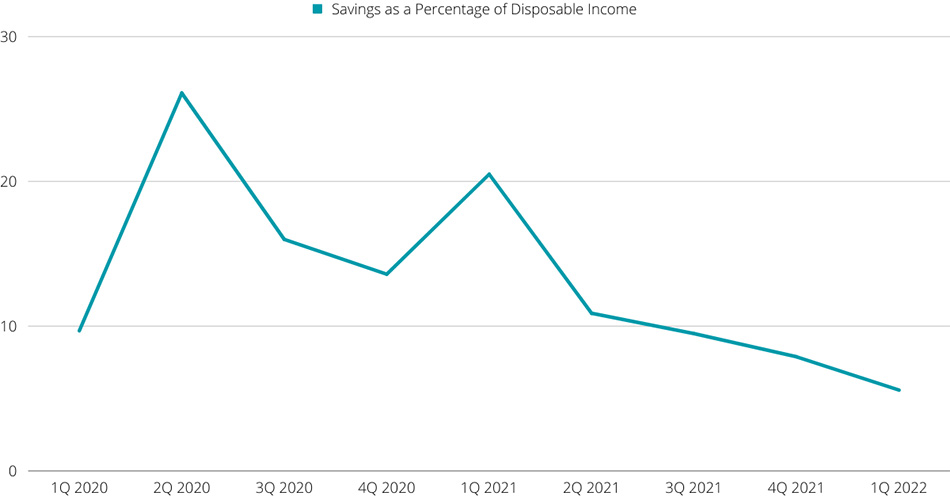

Americans are saving less of their income overall

Meanwhile, Americans are saving less and less of their disposable income. The U.S. personal savings rate—that is, how much Americans save after paying their bills—was at 5.4% in May, a slight uptick after a several month decline, according to data from the Bureau of Economic Analysis. By comparison, the historical average personal savings rate has been 8.97% from 1959 to 2022.

When looking at the most recent data, it's important to keep in mind that the savings rate was elevated for the previous two years because of COVID-19-related government stimuli, noted Josh Denton, senior consumer product manager lead for BOK Financial.® Aid like the stimulus checks that tax payers received allowed many people to put more money away in savings than they otherwise would have, as did pandemic-related shutdowns which limited driving, travel and other spending, he explained.

That said, the most recent data also reflects how much workers are impacted by higher prices, Denton continued. "Many people are living on everyday wages. Although you hear about wage inflation, many in some sectors, like the service sector, are still struggling," he said.

Indeed, adjusted for inflation, average hourly earnings dropped by 3% from May 2021 to May 2022 and average weekly earnings decreased by 3.9%, according to data from the Bureau of Labor Statistics.

Don't blow unexpected income on an unplanned purchase

If you do receive extra income—such as from a tax refund or bonus from an employer—what you should do with it varies by situation, Denton said. "It comes down to what your savings and debt look like."

If you don't have an emergency fund of $1,000 to $2,500, use the money to help build one. If you do, your next priority should be to use the money to pay down high-interest debt, followed by building a larger emergency fund of six months' worth of expenses, he explained. "Six months can provide peace on mind and give you something to fall back on if life throws curve balls at you—which it will."

When deciding whether to keep your emergency fund in a savings account, money market fund or in your checking account, some factors to weigh are how easy it will be to access the money, how that level of ease may impact your intention to save, and the interest rate, Denton said. In terms of liquidity—that is, how easily and often you can access your savings—funds in a money market account are less liquid than those in a savings account, while those in a savings account generally are less liquid than those in a checking account.

Not having an emergency fund can damage credit, relationships

No matter how it's saved, having an emergency fund to fall back on if you should suddenly discover the need for a large unexpected expense or lose your income can help you avoid financial pitfalls like putting expenses on high-interest credit cards, using payday lenders and requesting loans from friends and family, Denton said. "Having to rely on friends or family in those situations could put a strain on relationships."

And that's not even the worst case scenario.

In Denton's words: "You might have to pause payments on utility bills and debt, negatively impacting your credit score, and making it more difficult and expensive to borrow in the future."

Intentionally planning ahead will pay dividends down the line, he said.

Tips for starting or building your savings

- Set a budget.

- Open a savings or money market account, if you don't already have one. This can be done from your mobile device in as little as five minutes through some banks' online applications.

- Set up automated savings contributions either by reaching out to a banker or digitally though your bank's website or mobile app. Putting money from each paycheck aside automatically—rather than you seeing the money in your checking account and deciding to move it into savings—"drives saving behavior," Denton said.

- If possible, consider other sources of income such as a side job and put that added income directly into your emergency fund

- Be intentional in your spending and saving. "It really comes down to developing a plan, budgeting and using automated tools," Denton explained.