Preparing for a financial setback

Your tax refund or annual bonus could help jumpstart your emergency fund

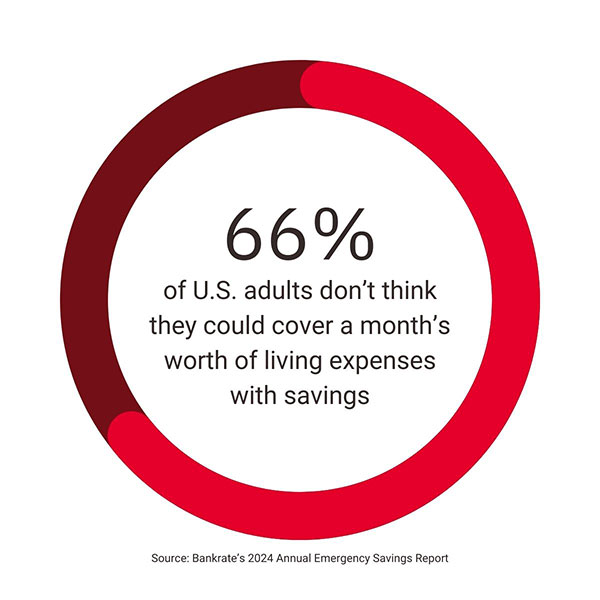

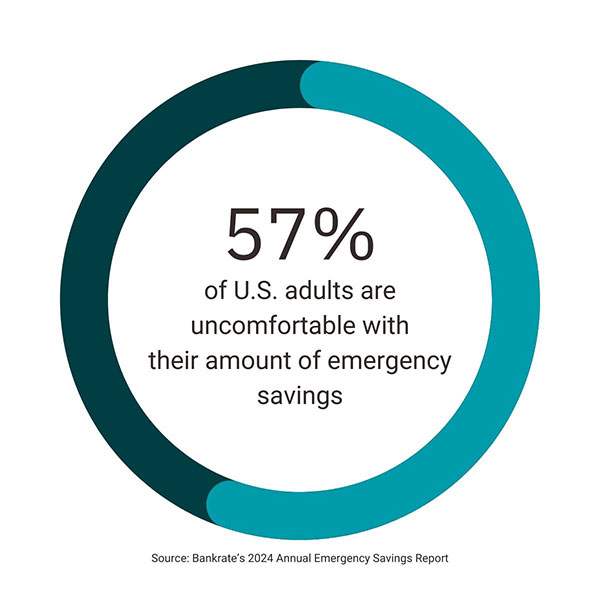

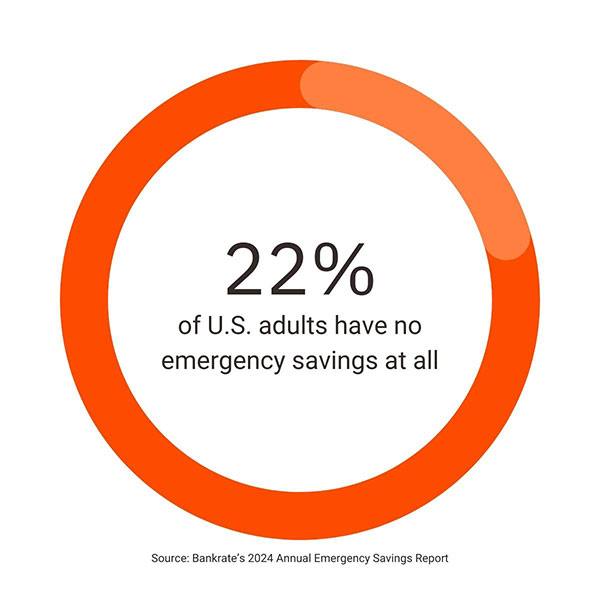

If you’re one of the 60% of Americans who feel behind on your emergency savings, you might be putting your household at risk of falling behind on payments or into debt when the unexpected arises, experts say.

"We all need to understand that emergencies are going to happen," said Jennifer Ellis, a senior consumer product manager for BOK Financial®. "Whether it's a job loss, a broken washing machine or car repairs, you need to think about them ahead of time."

It’s a lesson that one Oklahoma family learned amid the pandemic—and it has served them well since.

In July 2020, Gideon Seaman lost his job. Fortunately, his family had Covid-related stimulus money to get them through while he searched for a new job. That search took three months.

“From our experience with him losing his job, we realized three months is a good amount of savings to have,” Gideon’s wife, Amanda, said. “That became kind of our golden number.”

Gideon found a great job with an EdTech software company, and the couple set their sights on building a new three-month emergency fund to mitigate future financial setbacks. As it happens, their timing was perfect.

Fierce storms hit Oklahoma causing major flooding in their area. The floods destroyed the ductwork under their home and severely damaged another building on their property. It happened on their wedding anniversary—they dubbed it the “floodaversary.”

Around the same time, their water heater went out and their septic tank “totally collapsed.”

"It was just so many catastrophic things hitting one after another,” Gideon said.

But they were fortunate. Drawing from the lesson of his months-long job loss, they had replenished their three-month emergency fund and were able to repair and restore their property with the funds they had saved.

“When you have a first-aid kit, it’s just easier,” Ellis said. “It removes a lot of that stress from you.”

How to create—or replenish—your emergency fund

The key is to start building your emergency savings now, even if there aren’t storm clouds on the horizon or you don’t have a lot of excess cash lying around. “Everybody has to start someplace,” Ellis said. “Start small, if you have to, by figuring out what you can put aside in the short, medium and long term.”

Ideally, an emergency fund should be in an easily accessible place such as a personal savings account. Plan to contribute something to the account as often as you are able. To help create the habit of saving, Ellis suggested having funds automatically transferred into the account. For example, BOK Financial’s “QuickSave” option automatically transfers $.25 or $.50 into savings every time you use your debit card for qualifying purchases.

Alternatively, you could set up automatic transfers into your savings account of any amount and at any interval of your choosing, such as every time you get a paycheck.

After the emergency savings fund is filled, consider long-term savings options like an IRA or CD.

This is exactly what the Seamans did. They made a conscious decision to prioritize their financial security after the lessons they learned in 2021 and 2022. They saved enough for their three-month emergency fund and then extended that to a six-month fund in a dedicated savings account.

“As far as financial planning goes, you have to prioritize your own family’s safety from financial risk; the only way to do that is to pay yourself first effectively and to put that money somewhere you won’t touch," Gideon suggests.

Always be prepared

Some may be using their emergency savings sooner rather than later, as employment trouble may be coming this year. According to Employee Benefits News, 92% of employers are expecting to lay off workers in 2024. That’s in addition to the 96% that downsized in 2023. Whether or not such broad workforce cuts materialize, it underscores the necessity of prudent financial planning today, experts said.

Plus, with tax and bonus season coming up, you may be asking yourself, “What could I do differently with this money than I’ve done in the past?” Ellis noted. One option is starting or replenishing your emergency fund, along with taking careful inventory of your expenses.

“If you haven’t evaluated what your expenses are in a long time, I would suggest you do it now,” she said. “That process will help you consider what steps you can take today that will set you up for future success.”