4 ways retirees can navigate falling interest rates

Many seniors in or approaching retirement will need to adapt

After months of talk and speculation, the Federal Reserve appears ready to lower rates, amid lower inflation and concerns about the cooling labor market.

Many expect the first rate cut to come at the Federal Open Market Committee’s (FOMC) Sept. 17-18 meeting, which would mark an adjustment to the Fed’s course of keeping rates higher for longer to sustainably bring down inflation. Meanwhile, the high-rate environment has made many types of borrowing more expensive, with average credit card APRs at 25% - 29%, as of August 2024. Financing has also become more costly over the past two years on items like cars and homes.

Though a burden for borrowers, higher rates have been a boon for savers, many of whom have consistently earned about 5% from high-yield savings accounts or CDs with little or no risk.

However, this all may change as the Fed incrementally cuts rates, experts noted.

“The days of nearly risk-free, 5% returns are numbered, at least in the near term, so it’s a good time to capture what you can.”- Joan Fields, private wealth advisor with BOK Financial®

Retirees’ concerns

With their active-earning years largely behind them, retirees have been hit particularly hard by inflation impacting their cost of living and how long their assets will last.

Adding in the market’s volatility and election-year jitters, retirees are understandably concerned about the impacts of falling interest rates, Fields said. “Among all the uncertainties, clients are seeking to preserve the higher rates of return they’ve become accustomed to.” These higher rates of return are a recent phenomenon, as comparatively returns were scant from late-2008 through mid-2022 when rates were often less than 1% and rarely exceeded 2%.

Actions to consider now

With rate cuts appearing imminent, Fields suggested several actionable ideas while rates decline, though the timing and the incremental amounts of cuts will be determined as time unfolds.

- Lock in rates. By moving some “sideline cash” into bonds or CDs, clients will likely still capture rates above 4% for the next year or so, said Fields. “We’ve been locking in rates to get clients into longer-term strategies where maturities are pushed out longer, and to help get stability on the rate side.” Staging or laddering those maturities at six- or 12-month intervals also can be beneficial when rates are in flux, she added.

- Rebalance your portfolio. With the Dow Jones Industrial Average up over 8% and the S&P up nearly 16% through July 2024, many portfolios’ allocations may be out of sync. “By rebalancing, owners can realign their assets to current or anticipated needs. By realizing some gains or losses, proceeds can be redirected into more fixed-income instruments to achieve income or return certainty,” said Fields.

- Reduce debt. Though lower interest rates can mean cheaper financing, having too much debt can still compromise wealth building. By minimizing debt, retirees can both add to their worth and reduce stress. To tackle credit card or other variable-rate debt, consider a transfer to a zero-interest card, or a less expensive personal loan or home equity line of credit. However, mortgage balances and home equity debt also can be problematic for retirees, so it’s important to take on any debt strategically and wisely.

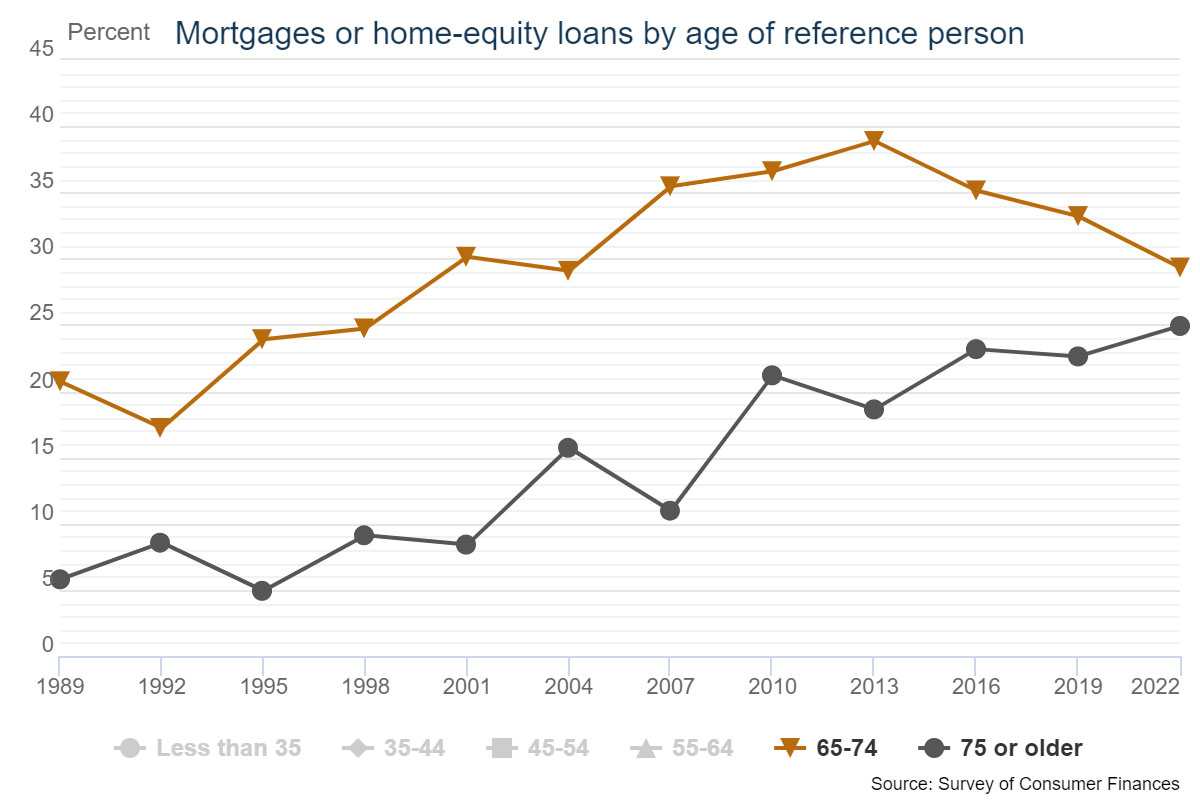

Studies indicate that, from 1990-2022, the share of retirement-age homeowners with a mortgage rose from 38% to 51%, and that instances of mortgage or home equity debt grew from 5% to 25%, among those 75 or older.

For those who have taken out loans at the higher rates over the past two years, experts recommend considering ways to put those gains to work by paying toward principle whenever possible. “I’ve been discussing the opportunities to use gains from investments over the past year to help pay down loans when the gains are not needed for income,” said Jessica Jones of BOK Financial Advisors. “That approach helps you pay off auto, personal or business loans or home equity lines of credit sooner to help lower the burden of your high-rate debts.” - Change residences. Homeowners who’ve considered but hesitated to downsize or otherwise relocate may have a renewed incentive to do so. Selling a home can convert equity into the cash needed for a next chapter of life—or be used to offset reduced interest income. Fixed-rate, 30-year mortgages have fallen year-over-year from nearly 8% to 6.5%, and mortgage rates may fall further as the Fed lowers the Federal Funds rate. Though supply side challenges in housing remain, availability at senior-age and 55+ communities may be better, with new construction spurred by a demographic shift in which all Baby Boomers will be aged 65 and older by 2030.

Easier for some than others

Meanwhile, how much retirees’ portfolios will be impacted by falling rates will vary widely. Owners of modest portfolios have less flexibility to pivot or shift their assets than peers with greater resources, Fields noted.

“Some retirees can’t as easily buy into fixed-income solutions as rates fall,” she explained. “Many will need to either maintain savings account liquidity, even at reduced returns, or keep a strong position in equities in search of growth. Some may need to do both.”

An overarching solution

Fields believes that an optimal solution, despite market volatility and changing rates, is to have a financial plan developed by a qualified adviser, a professional who can guide you objectively and without the emotion or level of risk that often accompanies self-managed plans.

“An accredited professional with years of experience who has worked through the natural ups and downs of the market is ideal for retirees or prospective retirees to have,” she said. “We can model your assets to your goals and needs, stress-testing them against various market scenarios, including rate changes. For many clients, the result is a level of assurance that allows them to sleep at night.”

Whatever your age or capacity as a retiree, Fields said, it’s important to balance your risk, growth and comfort level against the economy’s changing circumstances to better enjoy the later years you’ve earned.