Potential homebuyers anticipate lower rates

Mortgage rates are dropping—but other areas of the economy will feel a larger impact

While many borrowers celebrated the Fed’s decision to start lowering rates, that doesn’t necessarily mean that mortgage rates will quickly follow suit.

The Federal Open Market Committee (FOMC) announced in September that it would cut the Federal Funds rate by half of a percent to a target range of 4.75% to 5% due to cooling inflation and concerns that the job market is weakening. The FOMC is expected to cut rates further at its November meeting and possibly again in December; however, the immediate effects of the move are just beginning to be seen more broadly.

How rate cuts affect the mortgage industry

Steve Wyett, chief investment strategist at BOK Financial®, said it’s a common misconception that the Fed ultimately controls mortgage rates. Instead, home mortgage rates are more responsive to long-term inflation, so they should come down over the next 12 months, rather than immediately.

“Rates can come down a little more, but there’s a message in there for borrowers: if the expectation is getting back to 3% mortgage rates and the Federal Funds rate back to 0%, that scenario feels more affordable–but reality would be that unemployment would be higher with a negative economic impact,” he said.

“The broader economic impact of the rate cuts continuing might be detrimental to the market as a whole.”- Steve Wyett, chief investment strategist at BOK Financial

Overall, Fed rate cuts create a more favorable borrowing environment, but there are costs, according to Sherri Calcut, president of BOK Financial Mortgage. “Rate cuts benefit both prospective homebuyers and current homeowners looking to refinance. However, the lower rates can also lead to increased competition and rising home prices.”

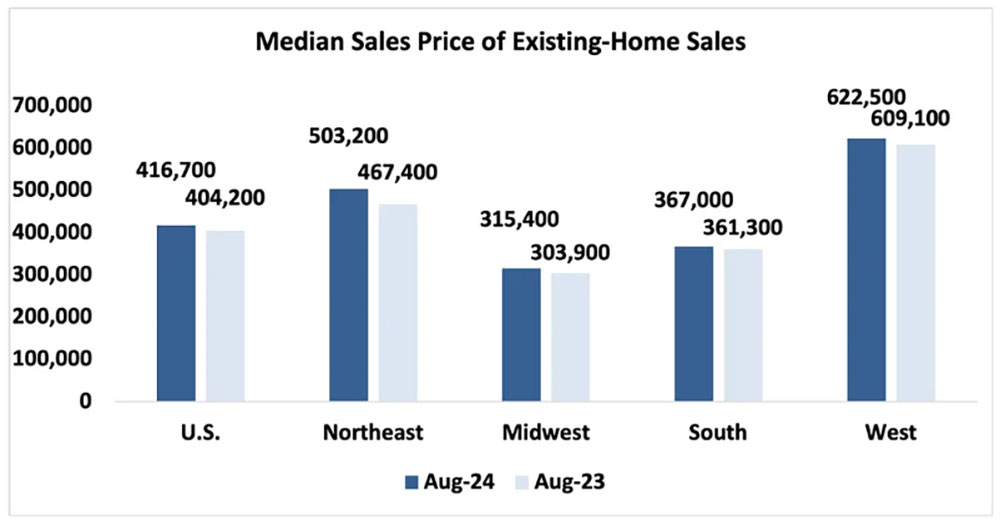

Meanwhile, high home prices are already an issue for many prospective homebuyers. The national median existing-home price hit $416,000 in August, which is a 3.1% increase from one year ago, according to the National Association of Realtors.

Existing-Home Sales Slide in August 2024

“The bigger issue we’re seeing impacting affordability is price,” Wyett agreed, citing the shortage of new homes hitting the market and existing homeowners being less willing to move because of the low-rate mortgages they already have.

Calcut added that the Covid era brought a new lens that the mortgage industry, and consumers are still navigating through this today.

“The hope is that this environment will create a larger housing supply for first-time buyers, as families are trading up to newer and larger homes,” Calcut said. “The U.S. is still short the millions of homes needed to meet the future demand, so the focus needs to continue to be how to fill this gap.”

Considerations for refinancing

In the meantime, mortgage rates were already slowly decreasing before the Fed announced its September rate cut, which means that some homeowners are starting to become candidates for refinancing, according to Chris Maloney, mortgage strategist with BOK Financial Capital Markets. In fact, at the end of September, the percentage of total mortgage applications to refinance went above 50%–to 55.7%, specifically–as a result of the news.

“Most borrowers don’t have incentive to refinance fixed rates they were able to obtain when the Fed had rates at 0%,” Maloney said. “So, while there is a higher percentage of borrowers able to refinance now than compared to the past two years, historically speaking, a very large portion of homeowners are paying mortgage rates far below what’s currently being offered.”

According to Maloney, if you look at 30-year conventional loans pooled by Fannie Mae and Freddie Mac, somewhere near 65% of homeowners are paying 4% interest or less. He emphasized that 30-year mortgage rates would need to drop to 3.5% or lower to spur these homeowners to refinance their existing loans. “We’re still a long way from having a wave of refinancing hit the mortgage industry.”

If homeowners can recoup their closing costs within 18 to 24 months, it is typically worth refinancing for a lower interest rate and payment, Calcut added. “This usually requires an interest rate reduction of around 0.5% or more,” she explained. “But the dollar amount of the outstanding loan balance also plays a role in determining whether the rate is low enough to realize the benefit.”

Broader economic impacts for consumers

Moreover, consumers are likely to feel the impact of rate cuts most acutely in other ways, such as how they save their money, the overall health of the U.S. economy and their borrowing costs, experts noted.

For instance, the high Federal Funds rate benefitted savers because money market accounts, high-yield savings accounts and other short-term savings vehicles paid more interest—but now that's changing. “In one sense, it’s a less attractive market to be in when rates are lower but higher rates are a boon for savers,” Wyett explained.

At the same time, by lowering borrowing costs, rate cuts can stimulate broader economic activity, which is positive for consumers, Calcut noted. “Consumers have more disposable income due to lower mortgage payments or refinancing savings,” she explained.

Additionally, consumers and businesses with debt like credit cards and auto loans benefit when short-term rates fall because the interest charged on these loans decreases as the Federal Fund rate falls. As of Oct. 4, the average credit card interest rate was 20.51%, down from a record-high of 20.79% in August. The average auto loan interest rate for a new car in the second quarter of the year was 6.84%, and 12.01% for used vehicles, according to Experian.

And so, while potential home buyers have been cheering the idea of lower rates, there’s much more at stake than mortgage rates declining over time.

“If people are looking to the Fed to help with lower rates, the home mortgage rate is not where we will see the biggest impact,” Wyett said. “The cuts have more of an impact on credit cards, auto loans and bank loans, which directly impact the consumer.”