Money talks: Do you need a third wheel?

How third-party professionals take the stress out of difficult financial conversations

Editor's note: This is part two of a four-part series on financial conversations. Read the first, third and fourth articles in the series.

We usually think of a third wheel as awkward—but when it comes to money, bringing in an expert might just save your relationship from emotional strain. Whether it’s signing a prenuptial agreement or discussing long-term care with aging parents, financial conversations are tough. But instead of avoiding them, consider adding a “third wheel”—a financial advisor, lawyer or accountant. These professionals don’t just manage the numbers; they remove the emotional weight, experts say—helping you and your family focus on the facts, not the feelings.

The role of third-party professionals

Including a financial advisor, lawyer, financial therapist or accountant to mediate sensitive money discussions helps reduce emotional strain and ensures decisions are made with professional guidance, experts said. These pros bring objectivity and experience to the table, allowing family members to focus on the bigger picture rather than getting bogged down in potential disagreements.

“That's where an advisor can help take some of the emotion out of it,” explained Victoria Ungashick, private wealth executive at BOK Financial®. “They bring a high level of emotional intelligence to navigate those conversations, and at the same time, they can help provide education and advice.”

Unlike most of us, financial experts are used to handling sensitive, high-stakes conversations, Ungashick said. Their expertise goes beyond managing numbers; they’re also skilled at guiding difficult discussions with emotional intelligence. Plus, by involving a third-party professional, you can step back from leading the conversation, allowing it to unfold with less pressure and more clarity, which often leads to better outcomes.

Ungashick highlighted how an expert can ease the pressure of trying to handle everything yourself. “Parents in particular want to ensure they handle the transfer of wealth to their kids in the ‘right way,’” she said. “Whether discussing paying for college or a future inheritance, these are appropriate conversations to have with your advisor, who is knowledgeable in these topics and can share tips and approaches for navigating that transition.”

More experts = more paperwork

When involving third-party experts, it's essential to store, organize and share the important documents they’ll help you create and update. Over time you might accumulate a will, a trust, retirement accounts, a financial plan, property titles and more. These documents should be securely stored, with copies accessible to trusted family members and professionals, Ungashick said. Safes are common recommendations for long-term security but be sure your designated administrator knows how to access these documents.

Be mindful not to store important documents so well that no one can find them when they’re needed. Completing an easy-to-use guide for your loved ones to use in the event of your death can be incredibly helpful during a difficult time. Or maybe you ask your aging parents to fill out the guide. “Not only does this type of guide help with organization, but it also provides a natural opportunity to begin having those difficult conversations,” said Ungashick.

Choosing the right “third wheel”

Finding the right professional is just as important as having the conversation. Look for experts who are empathetic, patient and will tailor their recommendations to your family’s needs. “Beware of anyone who provides advice without understanding your situation,” said Ungashick. “It’s very hard to provide good advice to the masses.”

By working with these trusted third-party professionals, families can have awkward money conversations in a way that’s both productive and respectful, allowing for smoother life transitions and better financial outcomes.

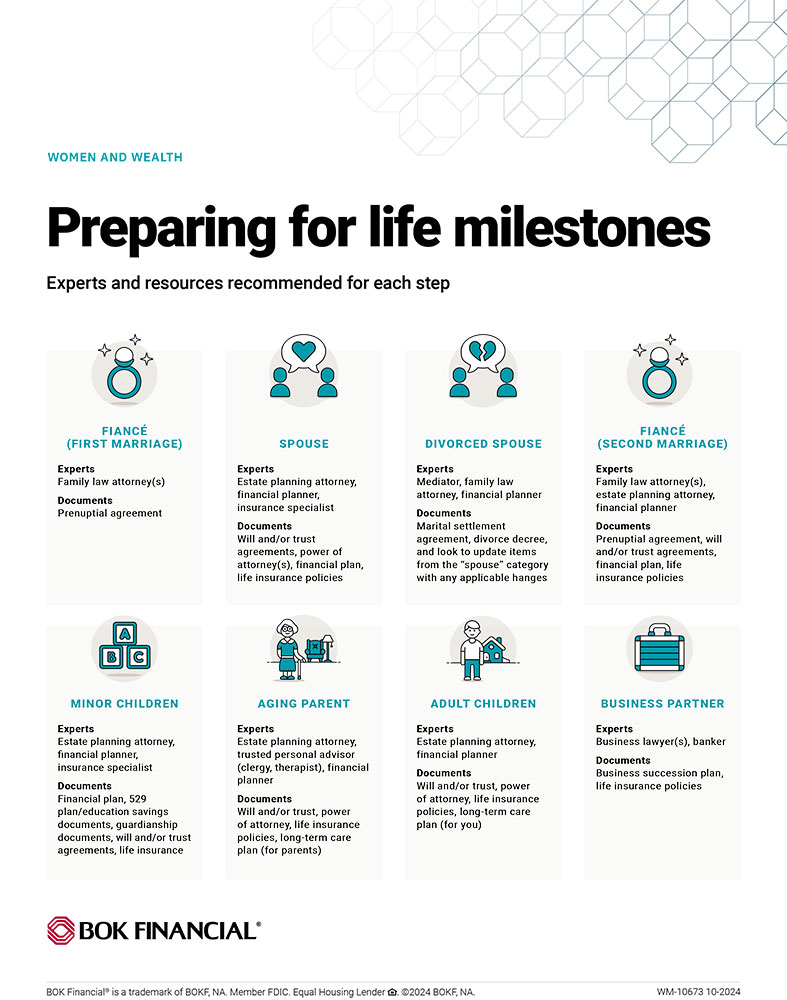

Resource: Preparing for life milestones

Download a list of experts and resources recommended for several significant phases you may encounter in your life. It outlines the experts to loop in and documents you’ll work together to prepare.

Learn more