Surprising January jobs data increases expectations for growth

Strong wage growth, among other data, makes March Fed rate cut look unlikely

As economic data goes, the Department of Labor’s (DOL) monthly report on employment is among the most important. Consumer spending is responsible for most of the U.S.'s gross domestic product (GDP), and having a job is the most important factor in consumers' spending ability. It takes a lot of time and effort to follow all the inputs to the report to have an idea of what we will see on the first Friday of every month. Usually, the consensus is within an acceptable range, although this report has a history of surprises. This month's report will go down as one of the bigger surprises we have seen in a while.

The trend in job growth, as reported as the nonfarm payroll number, has been slowing as the economic recovery ages. This trend is normal; it was considered when calculating the expected job growth for January to be around 185,000. January is also when annual seasonal adjustments are implemented, but this was factored into the expectation. Instead, we got what can only be called a blow-out number with new jobs totaling 353,000, twice the expectation, along with upward revisions to the previous two months' job growth numbers. This growth helped keep headline unemployment number at 3.7%, versus an expected tick higher to 3.8%. From an economic standpoint, this release furthers the idea of continued growth and lessens the chances of a recession. After getting our first look at fourth-quarter 2023 GDP at 3.3%, we would expect first-quarter 2024 growth to slow a bit. However, the most recent revisions to the Atlanta Fed's GDP model have increased to 4.2%.

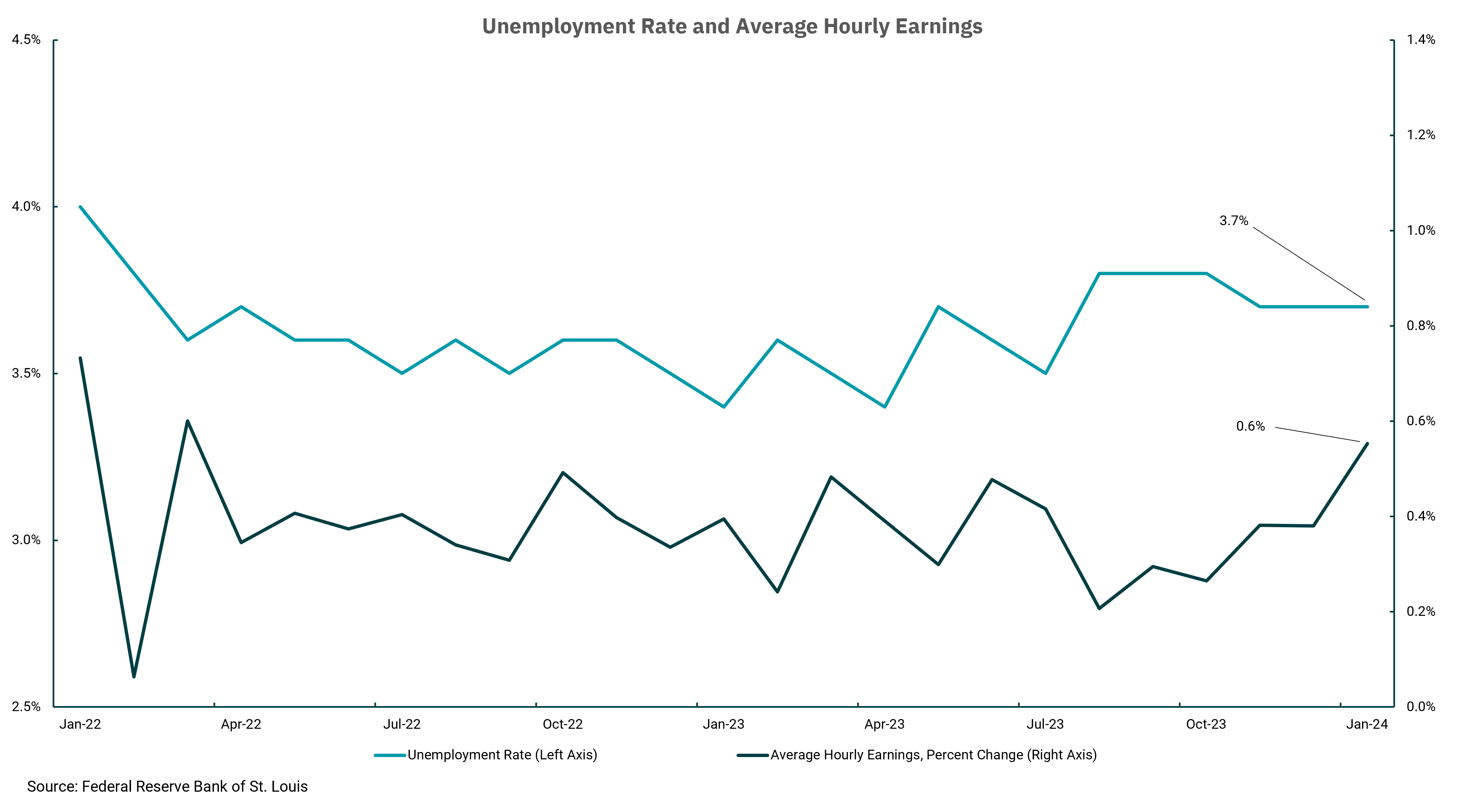

Within the number, we also get data on wages and the workweek. The news was more mixed within this part of the DOL's report. From this data, we are highlighting wage growth, alongside headline unemployment, in our chart. The ability of the economy to continue to grow and for the employment market to remain so stable over this period is remarkable, as this chart covers the period of the Fed increasing their overnight Fed Funds target rate by 5.25%.

Headline unemployment was 3.6% in March 2022, when the Fed began raising rates as inflation surged. With that in mind, a headline unemployment rate of 3.7% in the most recent report is an unexpected positive outcome, as unemployment has only increased by 0.1% since the Fed began raising rates.

The wage growth number, however, gives us reason to question how quickly the Fed will begin to reduce rates. For January, wage growth was reported at 0.6%, which resulted in a year-over-year increase of 4.5%. Both numbers are well above expectations, and since wages are a key part of the Fed's outlook on longer-term inflation, this increase (which continues a bit of a trend over the last few months) will almost certainly catch the eye of Jay Powell and his fellow Federal Open Market Committee (FOMC) members. The workweek data showed a decline of 0.2%, which lessens the sting of average hourly earnings, but while the labor market is becoming more "balanced," the Fed must remain vigilant to wage inflation.

The markets are reacting with higher interest rates as the timing of rate reductions is pushed further out, and stocks are mixed. However, from an economic standpoint, this is an outstanding report.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)