What will happen when the Fed starts cutting rates?

Even when rates fall, they will still be ‘restrictive,’ experts say

In a widely anticipated move, the Federal Reserve announced it would hold rates steady on Wednesday. Now, the bigger question of when rate cuts will begin still looms.

Although the most recent economic data was resoundingly positive—revealing a “near-ideal” condition of higher inflation-adjusted growth and lower inflation—there’s potential danger in keeping economic conditions this restrictive for much longer, experts said.

“Even if wages are sticky and inflation starts to trend upwards a little bit this year and settles at 3%, a 5.25% Federal Funds rate is still high,” said BOK Financial® Chief Investment Officer Brian Henderson. “The Fed has been very fortunate that the economy has not only held up, but also been pretty strong, while at the same time inflation has gone down. However, they do need to be careful about holding rates up too far, too long.”

The longer the Fed waits, the more different areas of the economy will be affected by rates being so high, he explained. “This year, around 6% of S&P 500 corporate bonds will come due, so that’s more corporate debt that would have to be rolled over at these higher rates. It’s still a relatively small percentage, but corporations paying this higher interest will be in a little bit of a pinch.”

Moreover, once the Fed starts cutting rates, it won’t mean that they’re shifting monetary policy from tightening (which is meant to slow the economy) to easing (which is meant to increase growth), Henderson added. “Even if they cut rates three times at 75 basis points (0.75%) each, the Federal Funds rate would still be considered restrictive, when adjusted for 2-to-3% inflation,” he explained.

Fed finding the right time to start cutting rates

For much of the past two years, the Fed has faced the challenge of avoiding a stop-and-go approach to rate hikes. The U.S. experienced the consequences of this approach in the late 1970s and early 1980s, when the Fed at the time increased rates substantially and then started cutting them when inflation started to come down—only to have inflation start increasing again—at which point the Fed had to raise rates even more.

Instead, the current Fed increased the Federal Funds rate by 5.25% over a span of around 16 months, reaching the current range of 5.25% to 5.5% in July 2023. Then, even as inflation has trended downward, the FOMC has decided to hold the Federal Funds rate where it is at every meeting since, with the aim of achieving a “soft landing” for the economy rather than a recession.

Now, the Fed is preparing financial markets for rate cuts, which likely will start right when the U.S. economy has felt the full brunt of the previous rate hikes, which take their time to percolate, Henderson said.

And when the Fed does start cutting rates, the positive effects will be felt first in the most rate-sensitive areas of the economy such as the housing market. “Mortgage demand is relatively low now, but when the Fed starts cutting rates, that’s going to help out rapidly. Plus, there’s likely some pent-up demand for housing, too,” he explained. Consumers and businesses with credit card debt are among the others who will feel the positive impact of rate cuts, quickly.

U.S. economy continues to surprise to the upside

Although fears of rising unemployment and recession have loomed for the past two years, they haven’t truly materialized. For example, unemployment was 3.7% in December 2023, only 0.1% more than when the Fed began raising rates in March 2022. And Henderson no longer believes that the figure will have to go over 4% before the Fed can safely start cutting rates. Some businesses have reduced the number of job openings they have rather than laying off existing employees, while others have taken the opposite approach and increased their workforce, he noted.

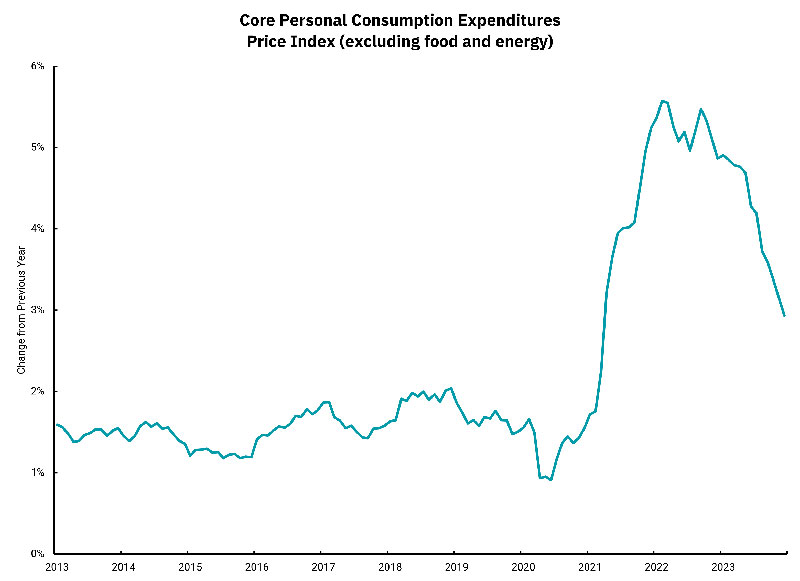

Meanwhile, even as quarterly gross domestic product (GDP) data continues to beat expectations, inflation has moved downward, contrary to what one might expect in a growing economy. The Fed’s preferred inflation measure—the core Personal Consumption Expenditures (PCE) Price Index, which is PCE minus food and energy—was slightly above the Fed’s 2% target at 2.9% year-over-year in December. However, if you annualize the past six months’ worth of data only, that figure is actually below the Fed’s target at 1.85%. For the past three months, it’s only 1.51%.

And what about recession? Are we safely out of the woods yet? Henderson believes that having a recession this year is very unlikely at this point.

“You can never say never but the economy doesn’t look anything like a recession to me,” he said.

“Recessions are caused by a shock. It could be interest rate shock, an energy shock or a financial market shock. We’ve had the shock, and we've made it through. If we were going to have a recession, it would have happened last year.”- Brian Henderson, chief investment officer at BOK Financial