Has the job market finally gone back to normal?

After reaching unseen levels, the ratio of open jobs to unemployed persons has been trending down

The employment market plays a material part in our outlook for the economy, inflation, interest rates, and Fed monetary policy. With roughly two-thirds of the U.S. economy driven by consumer spending, the first week of each month—when we get several job market data points—can set the tone for the capital markets. Let’s quickly review what we saw in the latest data.

The monthly employment report from the Department of Labor (DOL) provides the most comprehensive view of the labor market. Within that release, we see the overall unemployment rate, the number of new jobs for the month, wage information, the number of hours worked and the labor force participation rate.

January’s report rang some alarm bells, as job growth was very strong and wages advanced by a much stronger number than expected. The result was higher interest rates, as expectations for the Fed to begin lowering the Federal Funds rate were pushed further into the future. While other measures of inflation (and inflation overall) have trended lower, the Fed is keenly aware of the long-term nature of wage increases. This set the stage for this month’s employment report to be even more important.

The February report helped ease some fears of higher inflation. Average hourly earnings were only up by 0.1% (compared to up by 0.6% in January). Meanwhile, the number of new jobs in February was still a robust 275,000. January’s high reading on jobs—at 353,000—was revised lower, meaning the two-month average of new jobs is closer to our original expectations. At the same time, we saw the workweek expand a bit, which is good, while the labor force participation rate was unchanged at 62.5%, which is neutral. The headline unemployment rate increased by 0.2% to stand at 3.9%. The fact that it is below 4% extends a streak of low unemployment, which we have not seen since the 1960s.

Our recent commentary has highlighted the economy's path towards a “soft landing.” As the Fed began to raise rates back in March 2022, the consensus expectation was for the economy to slow and unemployment to rise. However, unemployment remained surprisingly stable as the Fed eventually raised rates to their current target of 5.25 to 5.5%. The headline unemployment number has moved from 3.6% to only 3.9%, an incredibly resilient performance. Furthermore, as employment remained strong, helping to support consumers, we saw overall inflation fall.

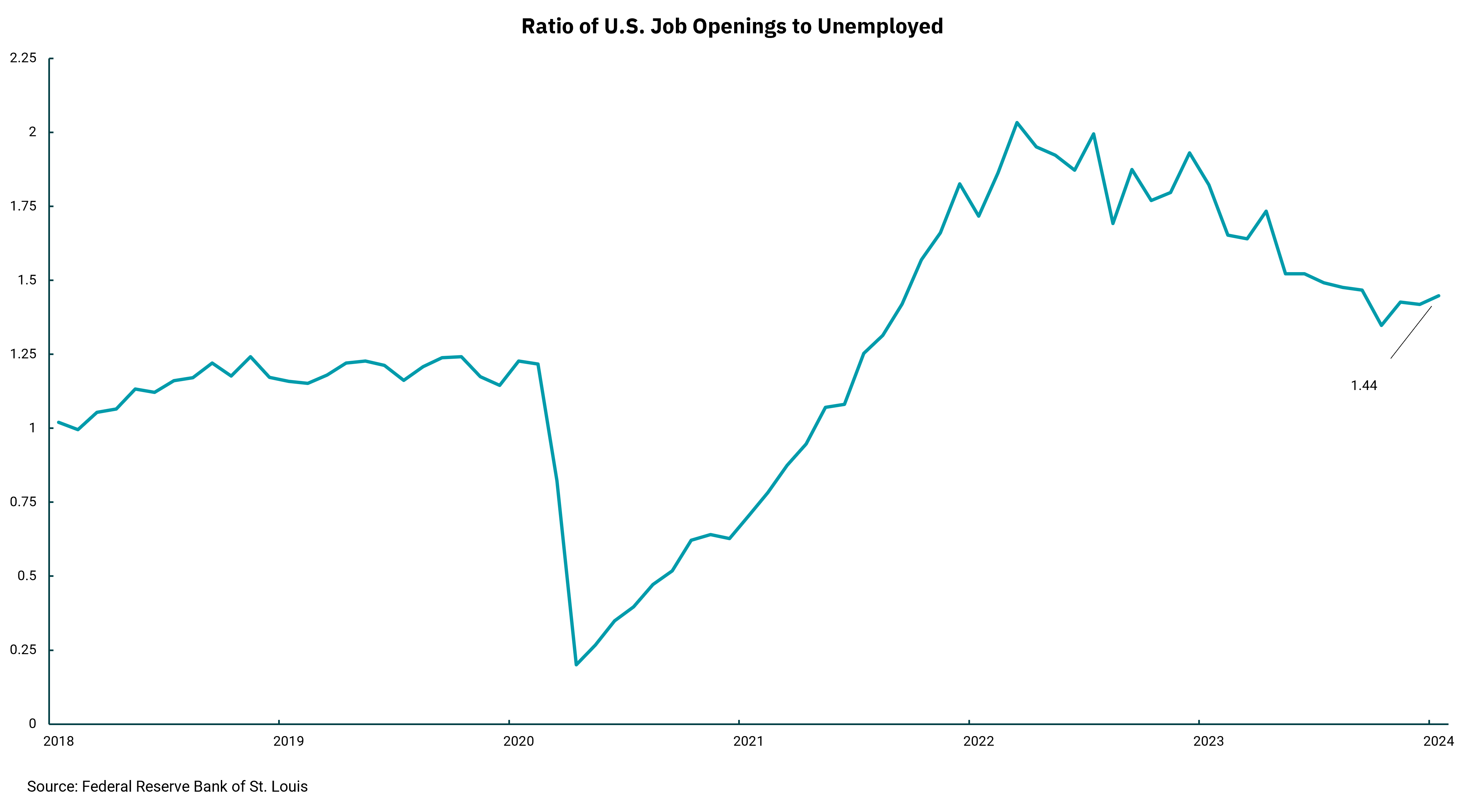

This week’s chart gives some indication of how that has happened. In addition to the DOL report, we get a monthly report called the Job Opening and Labor Turnover Survey, or JOLTS. Among the measures we see in this report are how many people are quitting their jobs and how many open jobs there are in the economy. We all know how crazy the job market got as we came through the pandemic, and the chart shows that the ratio of open jobs to unemployed persons reached unseen levels, peaking at two open jobs for every unemployed person. Since then, we have seen this trend decrease. The lower number of open jobs to unemployed persons and fewer people quitting their jobs indicates a more balanced labor market. The Fed needs to see this to have more confidence in inflation getting sustainably to their 2% target, so they can begin to reduce interest rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)