Is pessimism a cause for concern?

Consumer confidence declining, inflation expectations rising

In April, consumers’ year-ahead expectations for inflation surged to the highest reading since 1981, while their confidence levels continue to decline by multiple measures. Given that the majority of U.S. economic growth depends on consumer spending, is it time to worry about consumers’ worries?

Well, yes and no, said Steve Wyett, chief investment strategist for BOK Financial®. “The individual respondents to the sentiment surveys are not economists. Consumers and businesses make decisions based on how they feel—and the thing is that people’s feelings change often,” he explained.

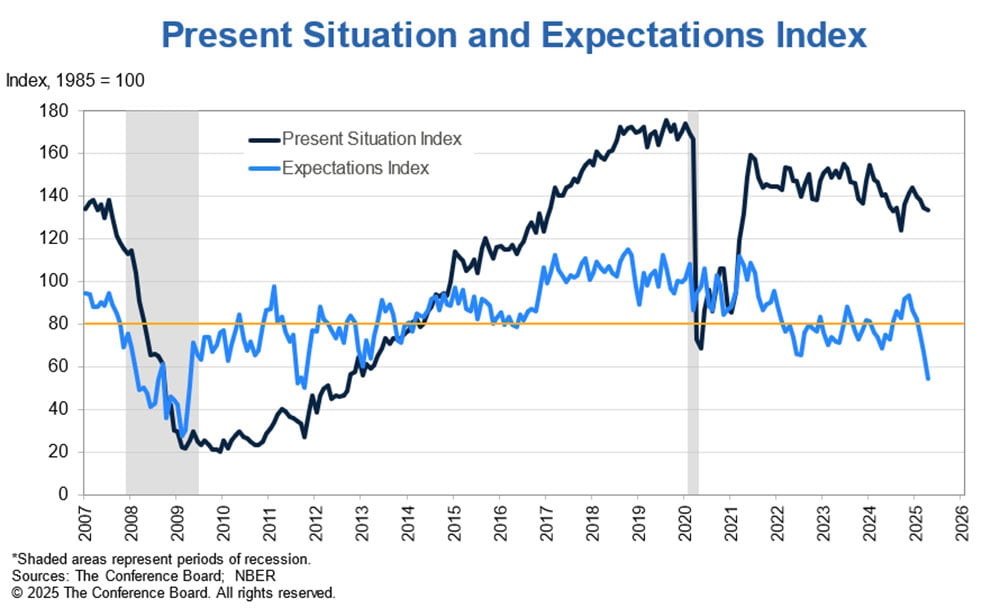

For instance, one of the most drastic changes can be seen in consumers’ short-term outlook for income, business and labor market conditions, which has taken an especially large hit. In October 2024, the Conference Board’s Expectations Index was at 89.1, above the threshold of 80 that usually signals a recession. This April, their expectations dropped to 54.4, the lowest level since October 2011, according to the Conference Board.

Sources: The Conference Board; NBER, US Consumer Confidence

However, BOK Financial’s base case outlook is still not for a recession, even though the economy is likely to slow.

Surveys indicate feelings, not necessarily facts

The fact is—because of their reliance on feelings rather than facts— “soft data” such as consumer confidence and business confidence surveys are not as reliable in indicating the state of the economy as “hard data” such as inflation readings and labor market reports, Wyett explained.

Nevertheless, these surveys are still important because, even if the absolute numbers matter less, the direction they’re moving in can still provide significant insight, he continued.

“In the past six months, consumer confidence levels have declined fast. What’s changed? The election,” he said.

In October 2024, a month prior to the presidential election, the Conference Board Consumer Confidence Index was at 108.7, an increase from 99.2 the month before. Comparatively, the index was at 86 in April 2025, a 7.9-point decline from March.

The University of Michigan’s Survey of Consumers reflects a similar pattern. In October 2024, consumer sentiment had risen for the third consecutive month to 70.5, while in April 2025 this figure fell for the fourth straight month to 52.2.

Optimism versus pessimism now more partisan

A major factor driving falling consumer sentiment is uncertainty, Wyett said, “I think a lot of it is just the massive uncertainty on a number of policy fronts.”

But some consumers are feeling more uncertain—and, consequently, less optimistic—than others, and the distinction is generally falling along political party lines. For instance, Republicans’ consumer sentiment level was 90.2 in April 2025, according to the University of Michigan’s Survey of Consumers. By contrast, Democrats’ sentiment was 34.4, and Independents’ was at 46.2.

On one hand, this variance in optimism is normal. “When Republicans are in power, those who identify as Republican always think the economy's a little bit better than Democrats do, and it flips both ways,” Wyett said. “But the shift after this election has been much wider than what we've seen as a result of past elections.”

In April 2021, after former-President Biden had taken office, resulting in four years of a Democrat in the White House, Democrats’ consumer sentiment level was 107.5, compared to 84.2 for Independents and 70.4 for Republicans, according to the University of Michigan’s Survey of Consumers.

And so, it’s not just that people feel differently about the economy depending on their political party, it’s that people feel more differently about the economy depending on their affiliation now.

Rising inflation expectations a worry

One of the pieces of “soft data” that may be an issue for the Federal Reserve is consumers’ rising inflation expectations, Wyett said. “Longer-term inflation expectations have been moving up some, and the risk of an echo wave of inflation is still in front of us.”

“There’s this inflationary aspect to some of the policies that are being put in place that puts the Fed in a really tough position,” he continued. “Underlying inflation is percolating at the same time that tariffs will have some negative impact on demand. There is also the risk of weaker economic growth, but the Fed can't lower rates because inflation is a little bit higher,” he explained.

“We're back to the potential for stagflation—but we're not there yet.”