Retiring in a down stock market

10 strategies for a smooth landing in financially turbulent times

Retirement is supposed to be the golden years, filled with relaxation, adventure, travel and more time with family. Yet, what happens when the stock market decides to throw a tantrum right before you retire? A market downturn can feel like a financial rollercoaster, but there are ways to navigate it without losing your sanity or your savings.

There are critical moves retirees can make during a shaky market—and few things to absolutely avoid doing, said Melissa Lord, director of investment fiduciary and consulting services at BOK Financial®.

Five steps to take before retiring

1. Educate yourself. According to Lord, one of the best things you can do is talk to an advisor who can take your unique situation and retirement goals into consideration. She also recommends attending any retirement seminars hosted by your company or financial institution.

2. Take a good, hard look at your finances with your advisor. Before you ride off into the retirement sunset, do a reality check on your finances. Your advisor can help you:

- Take inventory of your investment portfolio, retirement accounts and other assets.

- Review your sources of income like Social Security, pensions, 401k, annuities, and even part-time work and how much you plan to withdraw from each source.

- Be realistic when you estimate your retirement expenses—because let's be honest, those vacations aren’t free.

The last thing you want is to be forced into selling investments at rock-bottom prices. According to Lord, one way to cover your expenses in the meantime is by keeping a reserve of cash, especially if you plan to incur larger expenses immediately after retiring like relocating or traveling.

3. Diversification is your best friend. Don’t put all your eggs in one basket. According to Lord, you should spread your investments across different asset classes so one bad market swing doesn’t wipe you out. She also suggests continuing to contribute to your retirement account even if the market is down and you’re about to retire.

“Even though the S&P 500 is down so far this year, many people are still seeing positive returns because they are diversified in areas that haven’t been as affected as the market indexes we keep hearing about in the news,” she said.

She recommends the following:

- Have the appropriate mix of growth (stocks), income (bonds) and preservation (cash and money market) assets according to your time horizon and goals.

- Be diversified within broader asset classes. For example, allocate to international within your stock investments and different maturities within your bond investments.

- For cash reserves, use a “bucket strategy” with short-, mid- and long-term investments depending on your current and future liquidity needs.

4. Ditch the debt. Entering retirement with minimal debt provides greater financial flexibility, Lord said. Focus on paying off high-interest loans and cutting unnecessary expenses. If needed, downsizing your home or moving to a lower-cost area can also free up cash or decrease monthly expenses once you’ve retired.

5. Make a game plan for withdrawals. Your withdrawal strategy is like your retirement GPS: it’ll help you stay on track. The standard is the 4% rule, which means you withdraw 4% of your savings each year, adjusted for inflation.

However, Lord cautioned, “It’s a good target, but very dependent on how much you saved and the returns on your investments. You must have accumulated enough assets and be earning enough on your savings for this to be realistic. You need to have a good grasp on what your regular expenses will be, in addition to any larger expenses, to know what your withdrawal needs will be in retirement.”

Five steps to take after retiring

1. Pump the brakes on withdrawals. Pulling too much from your portfolio in a down market is like poking a bear—risky and unnecessary. Don’t start taking withdrawals unless you need the money.

“If the market is down and you’re under the required minimum distribution (RMD) age, you should consider leaving your money invested until the market recovers so you don’t lock in losses,” said Lord. If possible, dip into your cash reserves first or tighten up discretionary spending until the market recovers.

2. Rebalance, don’t panic. A downturn can throw your asset allocation off balance. Instead of panic-selling, work with your advisor to rebalance your portfolio periodically to keep your investment mix aligned with your goals.

3. Be smart about taxes. Taxes can sneak up on you, so plan wisely. Strategies include:

- Withdrawing from sources like Roth IRAs and Roth assets in a 401(k) plan to minimize taxes.

- Converting traditional IRA/pre-tax funds to Roth funds in low-tax years.

- Timing required minimum distributions (RMDs) strategically to minimize tax pain.

4. Stay flexible and roll with the punches. According to Lord, uncertainty of any kind, whether it be policy uncertainty like we’re seeing now or the uncertainty we saw during the pandemic, can cause emotional reactions, especially when money is involved.

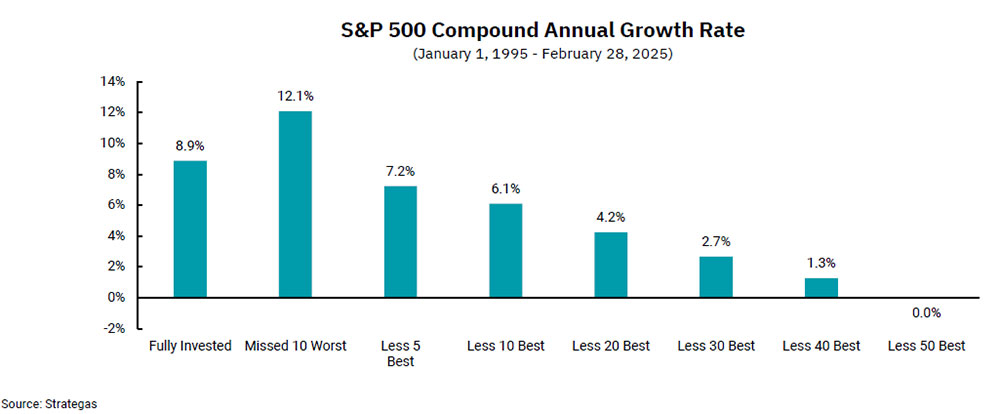

“The worst thing you can do is panic sell,” stressed Lord. “No one has successfully been able to time the top and bottom of the markets and missing just a few of the best days over the years could significantly impact your money.”

Selling stocks when they’re down locks in losses and kills your chances of benefiting from a rebound. Take a deep breath, step away from the news and stay the course, she said.

5. Don’t forget about healthcare costs. Healthcare is one of the biggest retirement expenses, so make sure you’re covered. Look into Medicare options, long-term care insurance and budgeting for medical needs.

A spike in volatility often leads investors to consider changes to their investment portfolios. However, timing the market can be challenging and often leads to inferior results. In addition, worst and best days can be clustered within tight time frames, making it even more difficult to time the market.

The chart shows the return on an investment in the S&P 500 Index from 1995 to 2025 with varying actions by the investor. Get more insights on patient investors being rewarded.

Can you retire now?

Of course, one option in a shaky market is to change your plans—at least, for now. “While not ideal, if your portfolio took a considerable hit leading up to your target retirement date, consider postponing retirement or adjusting your expectations so your money lasts as long as you do,” Lord said.

However, it’s important to keep in mind that’s not the only option.

After all, retiring in a down market might feel like sailing through a storm, but with the right strategies, you can still reach calm waters. Diversify investments, build a cash reserve, cut unnecessary expenses and follow a smart withdrawal plan.

Most importantly, Lord says it’s important to not panic—markets recover, and with patience and good financial habits, so will your portfolio.

The content in this article is for informational and educational purposes only and does not constitute legal, tax or investment advice. Always consult with a qualified financial professional, accountant or lawyer for legal, tax and investment advice. Neither BOK Financial Corporation nor its affiliates offer legal advice.