Credit scores are falling

What you should know about these numbers (and three ways to improve them)

KEY POINTS

- Credit score factors: Payment history, credit utilization, length of credit history, credit mix and new credit inquiries.

- Improvement tips: Regularly check your credit report, reduce outstanding balances and raise credit limits to lower utilization rates.

- Building credit: Use secured credit cards, become an authorized user and apply for credit-builder loans to establish a strong credit history.

In April, the national average FICO score, or credit score, dropped for a second time in a decade. This dip has been spurred by rising interest rates and debt loads, as well as the resumption of student loan delinquency reporting, according to the FICO release.

“While some might question their role, it is a reality that the financial system we’re living in is significantly related to credit scores,” said Josh Denton, manager of product strategy – lending for consumer and business banking, BOK Financial®.

“Having a good credit score is important; it impacts your ability to access capital and can contribute to your financial wellbeing.”- Josh Denton, manager of product strategy – lending for consumer and business banking

Consumers struggling with higher costs and debt

“Some economic indicators are reflective of problems that are negatively affecting average credit scores across multiple demographics,” Denton noted. For instance, in the last quarter of 2024, the percentage of credit card accounts that were at least 90 days past due hit a 12-year high, according to the Federal Reserve Bank of Philadelphia. Increased credit card delinquencies and the average drop in credit scores may indicate higher consumer stress, which could impact long-term borrowing power for individuals.

One factor is student loans. For student loan borrowers, October 2023 marked the end of the impact of the CARES Act, which resumed student loan repayment requirements but didn’t require delinquencies to be reported to credit bureaus. In October 2024, this practice ended, resulting in more delinquencies being reported, which has had a direct impact on individual credit scores.

What is a credit score?

Lenders use credit scores (which range between 300 and 850) to decide whether to approve you for loans, credit cards or mortgages, and what interest rate to offer you. Generally, scores above 670 are considered good, while scores above 740 are considered very good to excellent.

“Higher scores can qualify you for better interest rates and loan terms,” said Corrie Kimbril, consumer research and data risk analyst at BOK Financial. “Fundamentally, your credit score shows how likely you are to make timely payments when you owe money—whether it's for a loan or any other financial obligation. It helps organizations assess your risk of defaulting.”

What goes into determining a credit score?

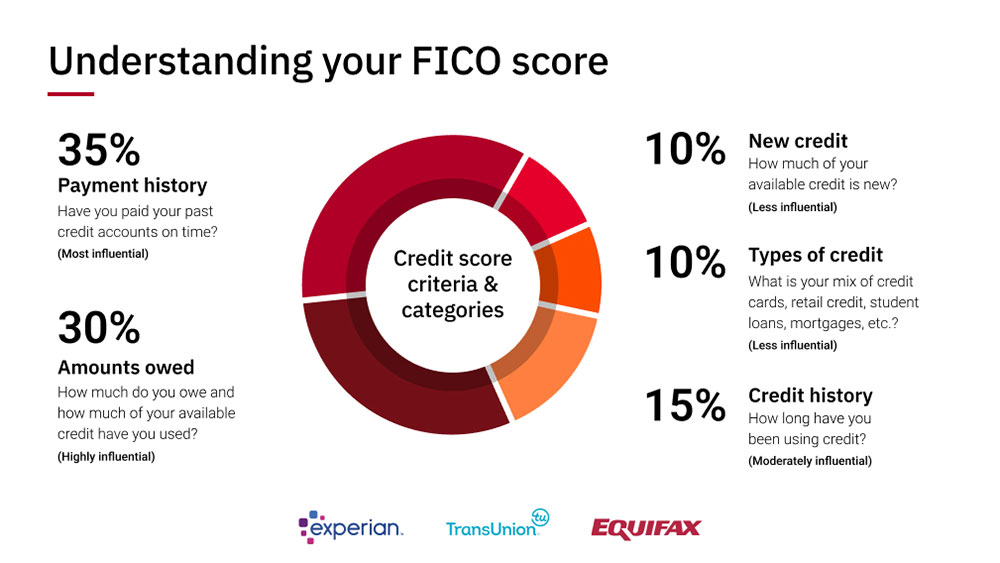

A FICO credit score is based on five main factors:

- Payment history (35%) – whether you’ve paid past credit accounts on time

- Credit utilization (30%) – how much of your available credit you’re using

- Length of credit history (15%) – how long you’ve had credit accounts open

- Credit mix (10%) – the variety of credit types you have (credit cards, mortgages, auto loans, etc.)

- New credit (10%) – recent credit inquiries and newly opened accounts

“When you talk about what's most important to your score, there are things you can do well and not do well, but the things you don’t do well carry a heavy weight,” Denton explained. “For example, you can set out to build your score, keep utilization rates low and make on-time payments with a good mix of debt. These all help, but if you miss one payment, that can offset several months of good behavior.”

Denton and Kimbril recommend thinking more holistically about your personal finances before focusing on credit score building. “It’s important to get your budget set right and cash flow consistent before you start to focus on building credit,” Denton said. “Fix the basics, get on a budget, and understand what’s going in and out so that you’re able to stay on top of any debt payments. These are the building blocks of personal finance.”

It’s also important to note that derogatory marks on your credit score can stay there for seven years, impacting your score in the long term.

How to establish credit

“For younger borrowers with no credit history, it’s important to start understanding what goes into a credit report sooner than later,” Kimbril said. Younger people who might need a car or get a credit card still need to establish credit history, and can do so with:

- Secured credit cards: These work by allowing you to put down a cash deposit that becomes your credit limit. You can use it for small purchases and pay the full balance on time each month until you can upgrade to an unsecured card.

- Become an authorized user: Ask a family member or trusted friend with good credit to add you as an authorized user on their credit card so their payment history helps build your credit.

- Credit-builder loans: This is like a savings plan that builds your credit at the same time. You make small monthly payments, and once you’re done, you get the money back. The regular, on-time payments help build your credit score because they are reported to the bureaus.

- Student credit cards: If you're in college, these cards have more lenient approval requirements and can be a good starting option for building credit.

- Apply for credit with your bank: Banks where you already have checking or savings accounts may be more willing to approve you for a credit card since they know your banking history.

“The entry point for building credit isn’t as important as how you maintain it,” Kimbril said. “If you use a credit card, don’t just make minimum payments—pay balances in full and use these cards wisely.”

How to increase your credit score

Payment history and credit utilization account for 65% of your credit score, so the key to increasing that score is in addressing these factors. But there are also ways to increase your score quickly:

- Check your credit report. Check to make sure that all of the accounts and debt listed are actually yours. If you find a discrepancy, file a dispute right away (this might result in an up to 20-point increase).

- Reduce the outstanding balance of your credit cards. Carrying balances can be detrimental, especially if you’re not paying them off in full each month. Reducing your debt load is a solid way to increase your score quickly.

- Raise your limit. Utilization is a key factor in credit score determination, so increasing your limit might help lower your utilization rate and increase your score. You can find out what your limit is—and if you can raise it—by asking the issuer of your credit card. (Just make sure you aren’t using that full amount).

Understanding your credit, how it’s determined, and keeping up with payments are all crucial to building and maintaining credit.