Feeling uneasy about the economy?

What you can do now to protect your financial future

KEY POINTS

- Create a budget: Understand your income and expenses to gain control over your finances.

- Build an emergency fund: Save three to six months of essential expenses to prepare for unexpected costs.

- Stay the course: Avoid making hasty investment decisions during market volatility and focus on long-term growth.

From rising prices and market swings to new tariffs and global tensions, the economy can feel unpredictable. However, financial experts say now is not the time to panic; instead, get grounded in the basics.

“People are anxious because there’s a lot of noise,” said Brandy Marion, retirement plans education manager at BOK Financial®. “But instead of focusing on headlines, bring it down to the personal level. What’s actually affecting you right now?”

Whether you’re worried about inflation, job security or just want to feel more in control, here are practical steps to help stabilize your financial life.

Start with a budget

“The first step is creating or reviewing your budget,” said Marion. “It helps you see where your money is coming from and where it’s going.”

Budgeting puts control back in your hands. It replaces uncertainty with clarity—and gives you a plan for responding to changes in income or expenses. For those just starting out, Marion suggests tracking spending for one month.

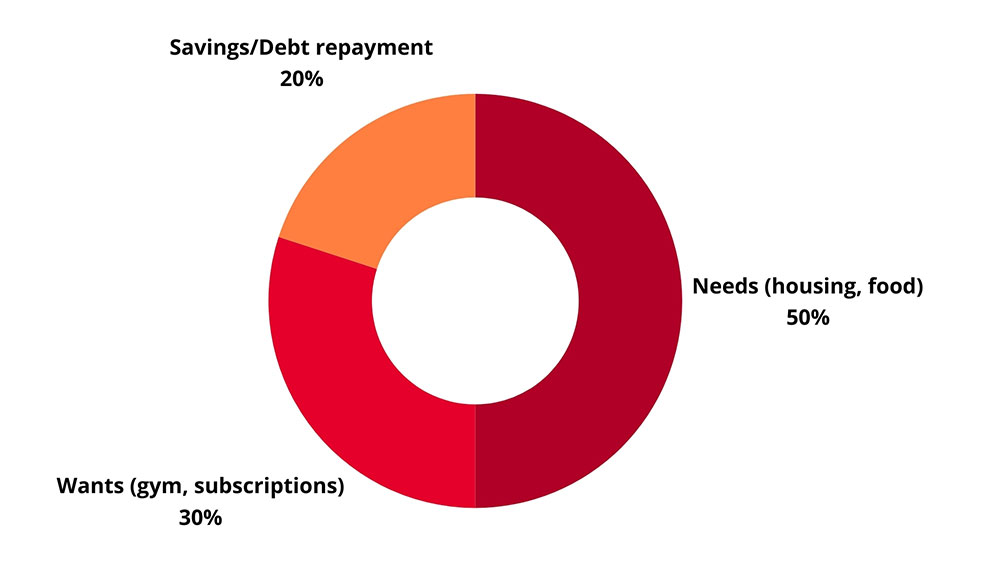

For those who want a simple starting point, Marion recommends the 50/30/20 rule. Under this model, 50% of your income goes toward needs like housing and groceries, 30% to wants like gym memberships or streaming services and 20% to savings and debt repayment.

“These are guidelines, not rules,” Marion said. “If your goal is to pay down debt faster, you might scale back your wants, but I never suggest eliminating them entirely. You need room to enjoy life.”

Once your budget is created, Marion suggests setting up automatic transfers into a savings account and adjusting your discretionary spending as needed.

Build or rebuild your emergency fund

Emergency savings are critical at any time, but especially during periods of economic uncertainty.

“When we don’t have money set aside for emergencies, it gets expensive quickly,” said Marion. “Most people who face an unexpected $400 bill end up relying on high-interest credit cards or borrowing from retirement accounts. That’s a costly cycle.”

If you’re starting from scratch, Marion recommends building slowly. Begin by identifying a small, realistic savings target. Even $20 or $50 per paycheck adds up over time.

Experts typically recommend saving three to six months of essential expenses, but Marion suggests tailoring your goal to your own situation. She recommends evaluating how long it might take you to find a new job or how comfortable you are taking risks. That will help determine whether you need a cushion closer to three months or one year.

Don’t let market volatility derail long-term plans

Market downturns can be unsettling, but pulling money out of your retirement accounts when the market is down can lock in losses and derail long-term growth.

“This isn’t crisis mode,” said Steve Wyett, chief investment strategist for BOK Financial. “Uncertainty has increased but a recession is not a given. In fact, some market conditions create opportunity.”

Marion encourages investors to stay diversified and stick with their long-term plans. She also notes that volatility can work in your favor through dollar-cost averaging—the process of contributing consistently regardless of market conditions.

“When prices are down, your contributions buy more shares,” she said. “That can lower your overall cost and accelerate your gains when the market recovers.”

For those 10 or more years out from retirement looking to optimize their retirement strategies, Marion recommends exploring Roth conversions during market dips.

However, if you’re closer to retirement, check in with your financial advisor for a tailored strategy.

Focus on what you can control

It’s tempting to respond to uncertainty with big decisions, but Marion encourages a measured approach.

“When the market feels out of control, we want to do something—anything—to feel better,” she said. “Instead, focus on what you can control. Your budget. Your savings. Your plan.”

“If you’re in an S&P 500 index fund, learn which companies are in that fund. Look at how those companies are doing, not just the market as a whole. It helps you understand the drivers behind your account balance,” she said.

One small step can make a big difference

If you do only one thing after reading this article, Marion’s advice is clear: Create a budget. That’s the foundation for everything else.

“In a noisy, ever-changing economy, it’s easy to feel uncertain, but most people will be okay,” she said. “We’ve been through downturns before. Steps like budgeting and saving don’t just help you feel more in control; they also put you on solid footing, so you’re prepared for what comes next.”