Can immigration solve the population problem in the US?

Shrinking labor force may lead to wage inflation, slowing the economy

KEY POINTS

- Without immigration, the U.S. population is projected to start shrinking in 2033.

- Fewer workers in the U.S. could lead to higher inflation and slower economic growth.

- A “cogent immigration policy” would be somewhere in between the two extremes of having open borders, on one hand, and aggressive deportations, on the other.

As in many developed countries, the population of the U.S. is aging and growing at a slowing pace, which experts say could mean workforce shortages—and, consequently, challenges with economic growth and rising inflation—down the road.

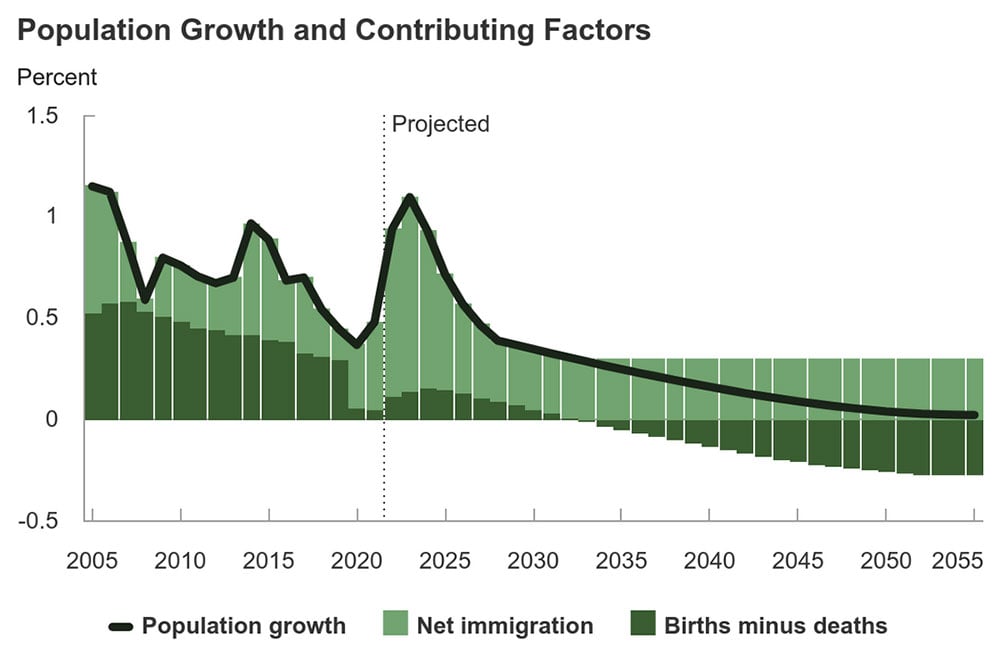

This year, the U.S. population is projected to grow by a nominal 0.1%, when taking into account births minus deaths without immigration, according to the Congressional Budget Office. Then, that figure is expected to drop to the negative, falling to -0.1% by 2035, and then continue declining to -0.3% in 2055, meaning that the U.S.’s population will shrink each year, based only on the expected birth and death rates.

Without net immigration, the U.S. population will start shrinking in 2033.

However, factoring in net immigration paints a different picture. For instance, even a net immigration rate of only 0.3% would result in positive population growth in 2035, according to the CBO. As the nonpartisan government office explains, “Net immigration becomes an increasingly important source of population growth. Without immigration, the population would shrink beginning in 2033, in part because fertility rates are projected to remain too low for a generation to replace itself.”

Why population growth matters to the U.S.

If the U.S. population does start to shrink, it could take economic growth down with it, which could have serious implications for the country, experts caution. “As we think about how the U.S. can handle rising budget deficits and/or rising national debt levels, being able to do that with a growing economy is much easier,” said Steve Wyett, BOK Financial® chief investment strategist.

Even just small increases in economic growth can dramatically improve the federal government’s debt-to-gross domestic product (GDP) levels. For instance, if economic productivity grows 0.5% more quickly than what the CBO expects, federal debt would be 124% of GDP in 2054, instead of 166% of GDP, according to CBO projections.

One way that economic productivity can increase is through advancements in artificial intelligence (AI). However, experts believe that higher productivity from AI alone won’t be enough. “In some industries, AI may be transformational,” said BOK Financial Chief Investment Officer Brian Henderson. He noted the efficiencies that AI is already creating in investment management. “However, for the broader economy, the increases in productivity from AI will be small increments. It will be a slow build,” he continued.

Besides increasing worker productivity through tools such as AI, another way that the U.S. economy can grow is by increasing the number of workers—and this is where immigration comes in, experts said.

“If we don't have immigration, our population is not going to support the kind of economic growth that we need going forward,” Wyett explained. “That's where the challenge and the opportunity for a cogent immigration policy from Congress could make all the difference in the world for us as we are moving forward.”

What would a cogent immigration policy look like?

This “cogent immigration policy” should be somewhere in between the two extremes of having open borders, which could impact the economy and pose national and local security risks, and aggressive deportations, which also could have negative effects on the economy, experts said.

As Wyett explained, “If the U.S. gets overly aggressive with deportations, then it will shrink the labor force. If we shrink the labor force, that probably means more competition for the remaining workers. If competition goes up, that might mean wages go higher. If wages move higher, that's going to be a problem from an inflation standpoint, and it would put the Federal Reserve in a position where they can't lower interest rates. If the U.S. has slower growth and higher inflation, that's called stagflation—and that’s not the outcome that anyone wants.”

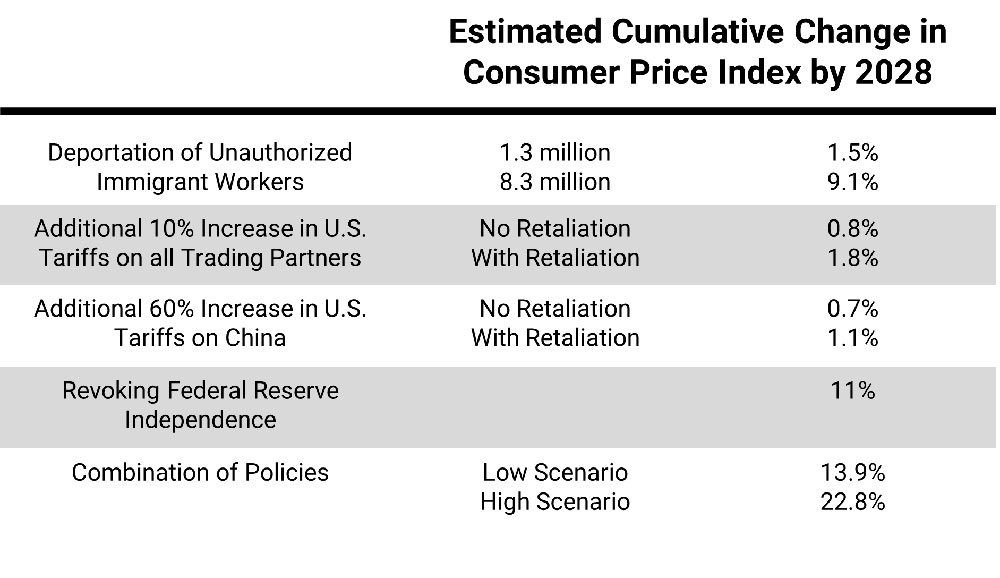

Deporting 8.3 million undocumented immigrant workers would cumulatively increase CPI inflation by an estimated 9.1% by 2028. By contrast, even an additional 60% increase in U.S. tariffs on China would only create an estimated 0.7% increase in CPI, if China doesn’t retaliate, and a 1.1% increase, if China does.

There were around 11 million immigrants in the U.S. in 2022, the most recent year that there is data available. However, the Pew Research Center is working on a new estimate based on the Census Bureau’s assessment that a net of 2.8 million people migrated to the United States between 2023 and 2024.

If 8.3 million undocumented immigrant workers are deported, that would cumulatively increase the Consumer Price Index (CPI) by an estimated 9.1% by 2028, according to data from Strategas and a Peterson Institute for International Economics working paper. That’s due to the fewer number of workers in the economy leading to greater competition for workers, which theoretically should bring up wages. By contrast, deporting 1.3 million undocumented immigrant workers would result in an estimated 1.5% cumulative CPI increase.

Is there an alternative?

For some countries, it is more important to have low rates of immigration than to grow its population and economy by that means, Henderson and Wyett noted, pointing to Japan as an example. “Japan is a very closed society. It's very difficult to immigrate into that country, and their population has been actually shrinking for some period of time,” Henderson said.

On one hand, Japan is contending with the same drags on population as the U.S.—an aging demographic and low birth rate—but also with very low net migration. For instance, Japan’s fertility rate was 1.4 in 2024 (representing the average number of children born per woman of child-bearing age, between 15 and 45), compared to a fertility rate of 1.6 in the U.S. that year. Meanwhile, net migration into Japan was 153,357 in 2024, compared to a net migration of 1,286,132 into the U.S, according to World Bank figures.

From the 1990s onward, Japanese companies such as Sony started responding to the country’s worker shortages by moving production or operations to other countries, including to the U.S., to maintain overall economic growth.

More manufacturing jobs may be coming to the U.S.—possibly with too few workers

Meanwhile, the Trump administration is taking the opposite approach from Japan, as both the administration’s tariff and corporate tax policies aim to encourage U.S. companies to move or maintain manufacturing and operations domestically, Henderson said.

These new manufacturing facilities would likely go in Middle America, where wages tend to be cheaper and there likely would be more workers to fill these types of positions, noted Matt Stephani, president of Cavanal Hill Investment Management, Inc., a subsidiary of BOK Financial Corporation.

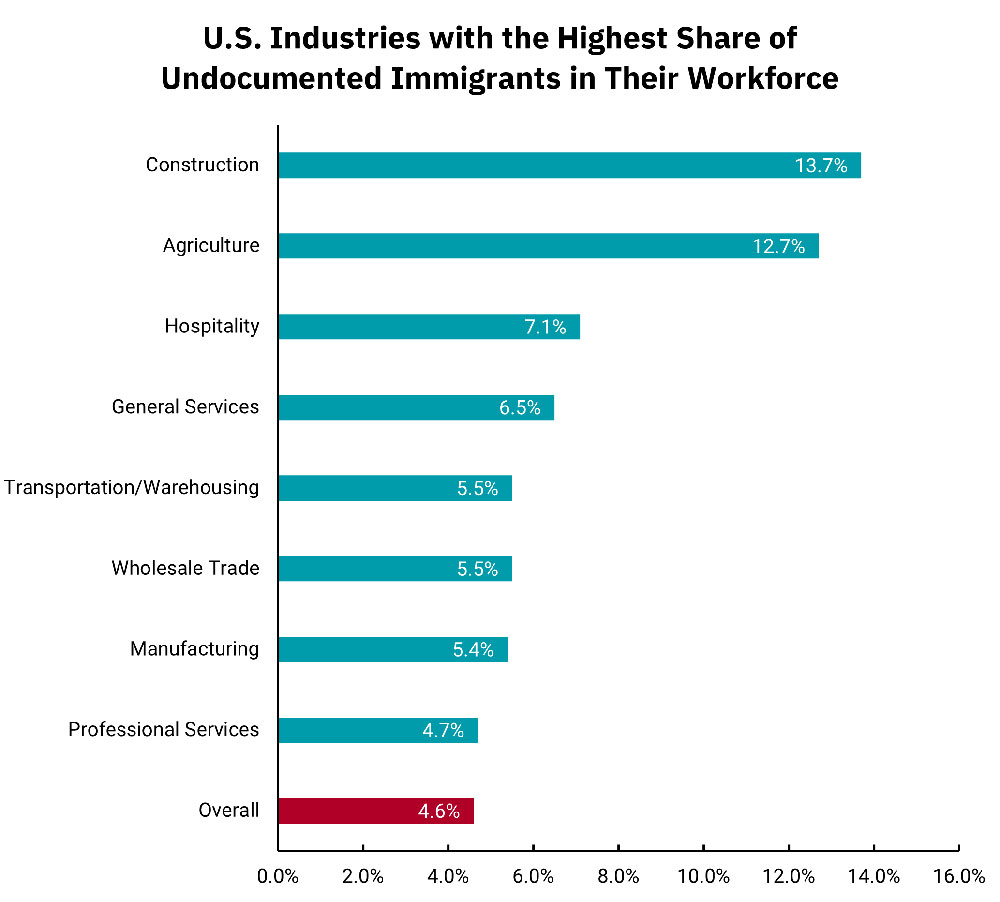

However, manufacturing is one of the sectors with the highest number of undocumented immigrants in the workforce, according to data from Statista. More than 5% of the U.S. manufacturing workforce is made up of undocumented immigrants, the data shows. In other sectors, such as construction, agriculture and hospitality, that percentage is much higher at 13.7%, 12.7% and 7.1%, respectively.

An overly aggressive deportation policy likely would mean that there won’t be enough workers to fill the jobs that already exist in these fields, Wyett cautioned. “It’s not like there's a huge amount of slack in the labor market showing that there are people here who can fill those jobs,” he said. “Those industries might not be able to operate.”

2025 Midyear Outlook

The first half of 2025 has been eventful, to say the least. A few of the geopolitical factors contributing to this uncertainty seem to have subsided a bit, but the economic impacts of tariffs and a stricter immigration policy, remain. To provide perspective on these topics and more, our investment management team has prepared an in-depth report, articles and webinar as its midyear outlook.