Strong on paper, shaky in practice

When the job market numbers don’t match the reality

KEY POINTS

- Corporate caution: Companies are hesitant to hire due to policy uncertainty, leading to slower decision-making and paused investments.

- Rise of gig work: More people are turning to gig work out of necessity, masking underemployment and financial stress.

- Labor mismatch: There's a growing divide between available jobs and the jobs people want, with high demand in trades but increased competition in white-collar roles.

At first glance, the U.S. job market looks strong. The most recent job numbers showed the unemployment rate fell to 4.1% and the U.S. economy added 147,000 nonfarm jobs, surpassing economists’ expectations. Weekly jobless claims also remain near historic lows.

However, dig deeper, and a more complicated picture emerges. Despite what the numbers suggest, many Americans are finding it harder to land a job, hiring is slowing and employees are staying in their current roles longer, whether they’re happy or not.

For job seekers and hiring managers alike, the signals feel contradictory—and the gap between data and reality is growing harder to ignore.

Why the disconnect?

“Most companies aren’t firing in large numbers, but they’re becoming much more hesitant to hire,” said Steve Wyett, chief investment strategist at BOK Financial®. “There’s a growing sense of caution that’s shaping behavior across the labor market.”

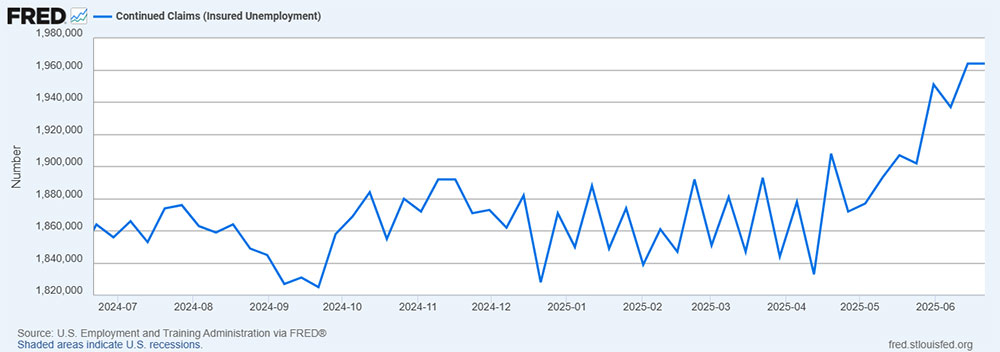

While unemployment hasn’t spiked, people who lose their jobs are generally taking longer to find new ones. That’s reflected in the steady rise of continuing claims, which track how many people are still receiving unemployment benefits after their initial filing.

1. Corporate caution

Wyett points to a high level of policy uncertainty as a major factor. “We’re in a really high-change environment. Between shifts in trade policy, energy, immigration and tax regulation, companies are unsure what the future holds. When uncertainty is high, decision-making slows down.”

In that kind of climate, hiring gets paused or stretched out. Investments are put on hold. Risk-averse behavior becomes the norm.

2. Gig work as a buffer and a symptom

More people are turning to gig work, such as driving for rideshare platforms or freelancing. Wyett says this has helped cushion some of the labor market slowdown, but it’s not a stable solution. “Most people aren’t doing gig work because they want to. They’re doing it because they have to. It helps make ends meet, but it doesn’t come with benefits or long-term security and often masks the full picture of underemployment and financial stress.”

3. Mismatch: Labor supply versus demand

There’s also a growing divide between available jobs and the jobs people want. Trades like HVAC, carpentry and plumbing work are in high demand and often pay well, but they’re not drawing from the same pool as laid-off tech workers or white-collar professionals.

“We’ve created a generation of college grads with the idea that any degree guarantees a great job,” said Wyett. “That’s not always true anymore, especially with increased competition and the effects of AI on certain roles.”

Even top-tier candidates are feeling the squeeze. Aimee Schwartz, director of talent acquisition at BOK Financial, shared that while the company is still hiring, the volume of applications has increased, so the competition for positions is greater. “We’re seeing hundreds of applicants for certain roles and a 12% increase in applications overall,” she said. “It’s taking longer to screen, interview and make decisions, because there are just so many candidates and high-quality talent in the market.”

Immigration: An essential economic lever

Wyett also believes that immigration policy plays a critical, often overlooked role in labor market health. “Industries like construction, agriculture and hospitality rely heavily on undocumented immigrant labor,” he explained. “If enforcement becomes even more aggressive, companies lose access to workers they need. That leads to cut hours, project delays and higher costs, including wages which will then increase inflation.”

It’s not just a political issue; it’s a demographic and economic issue. The U.S. population is aging, and the birthrate is declining. Without enough new workers, likely immigrants, our labor force shrinks, and so does the country’s capacity for economic growth.

Job market indicators

To get a truer sense of where the job market is headed, Wyett is closely watching:

- Trends in unemployment and continuing claims,

- Wage growth compared to hours worked,

- Personal income and spending patterns, and

- Immigration policy and enforcement.

“Our sense is that slower economic growth eventually leads to lower inflation and, therefore, lower interest rates,” said Wyett. “But we don’t expect the Fed to move quickly. The economy’s resilience may keep them on the sidelines longer.”

Tips for job seekers

Schwartz acknowledged that today’s job market can feel discouraging, especially when candidates apply to dozens of roles and may hear back very little.

“It can be deflating,” she said. “But I think it’s better to find the right long-term fit than to take a job just to have a job, then leave it a few months later when the opportunity you really wanted comes along.”

Her advice:

- Stay positive and stay grounded in what matters most. Focus on roles that align with your personal compass, even if the process takes longer than expected.

- Be patient and persistent. At BOK Financial, recruiters are seeing much higher application volume compared to last year. “It just takes longer for recruiters to work through and identify qualified applicants,” Schwartz said.

- Know that thoughtful hiring is intentional. “We’ve always held a philosophy of finding the right long-term fit for the employee and the company,” she said. “We’re not going to rush through our process to fill a seat.”

- Look for signs of employer care. BOK Financial takes pride in responding to every applicant, even if it’s not a match. “We can’t talk to everyone, but you should still get some form of communication from our recruiting team,” Schwartz said.

- Make personal connections, even if it feels uncomfortable. Schwartz said reaching out to your network can be the difference between landing the right opportunity and being overlooked. “It can feel vulnerable,” she noted, “but it’s good for both your job search and your mental health when the process feels discouraging.”

Where do we go from here?

The labor market isn’t collapsing, but it is shifting. Traditional metrics like low unemployment don’t tell the full story. As Wyett puts it, “It’s more complicated than a single number. You’ve got to dig into the trends beneath the surface to get a realistic picture.”

Whether you’re a policymaker, a hiring manager or someone looking for your next role, understanding those nuances is key to navigating what comes next.