Complex issues accompany transformative Texas boom

Local experts weigh in at Bank of Texas Economic Summit

KEY POINTS

- Texas continues to attract businesses and residents with its scale, diversity, and affordability—but faces mounting pressure on housing, energy and education systems

- Experts at the Bank of Texas Economic Summit emphasized the need for strategic policies to sustain growth, including immigration reform and skilled labor development.

- The rise of the “Texas Triangle” mega-region signals new opportunities, but collaboration across cities will be key to long-term success.

With rapid population growth, a burgeoning business environment and a state government laser-focused on national leadership, Texas has proudly established itself as America’s second-largest economy (behind California) and the eighth largest in the world.

Now home to five of the country’s 15 largest cities, the Lone Star State has been transformed by the past half-century from oil fields and ranchland to a corporate capital and mega-metropolis. This metamorphosis isn’t without its challenges, however, as the state grapples with growth-related issues from energy and housing to education and immigration.

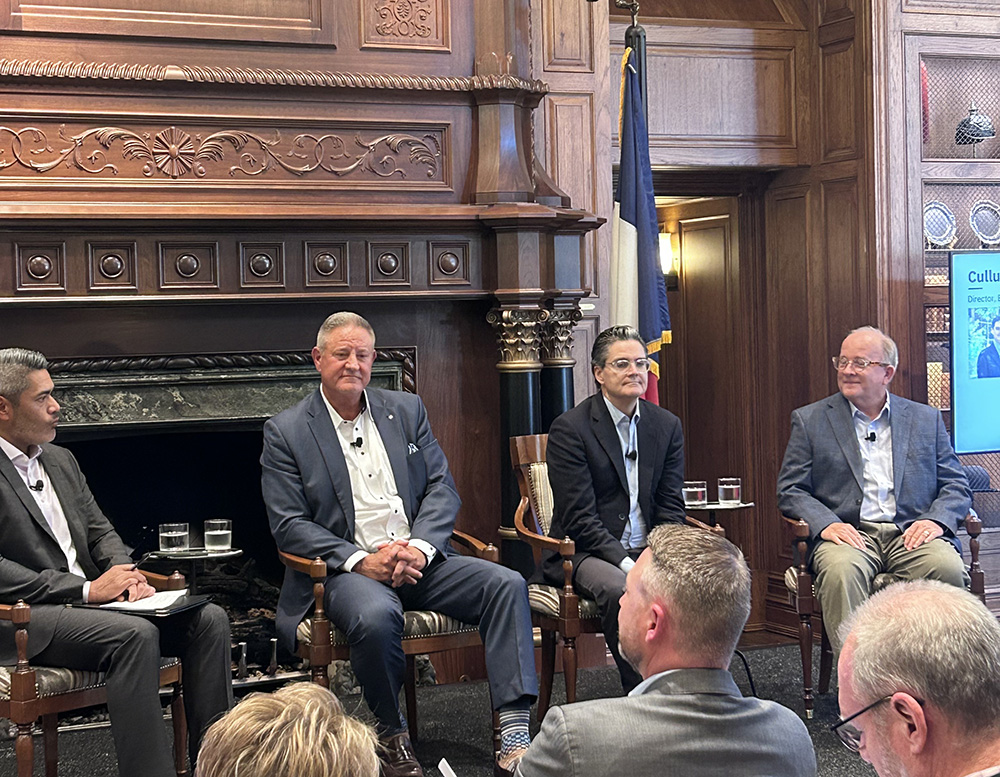

At the recent Bank of Texas Economic Summit, held in Dallas, a panel of distinguished speakers offered their thoughts on these and other issues. Steve Wyett, chief investment strategist at BOK Financial®, set the stage with an overview of economic hurdles at the national level before bridging to a group discussion of what lies ahead for Texas businesses and residents. Moderated by Ollie Chandhok, market president and publisher of the Dallas Business Journal, the Q&A session produced some thought-provoking insights on the Dallas-Fort Worth (DFW) area, in particular.

Big keeps getting bigger

Mike Rosa, SVP of economic development at the Dallas Regional Chamber, pointed to the opening of DFW Airport in 1974 as a pivotal moment in the region’s rise as a business magnet—and it keeps rising. In recent years, dozens of major corporations have planted roots to tap into the area’s large talent pool and lower costs.

“They see Texas as a business sanctuary, where most, if not all, of their needs can be met,” said Rosa. “The quality and scale of our offering at the price point [regulations, taxes, cost of living] is hard to beat.”

Cullum Clark, director of the Bush Institute-SMU Economic Growth Initiative, added that DFW’s success can be attributed to three key factors: size, diversity and manageability.

“Being big matters because, as the economy grows more complex, you have to have many different skills and resources operating in close proximity to meet the area’s needs,” explained Clark.

“Diversity of industry is also important. That’s how innovation happens—different industries collide and new industries are born. Lastly, manageability means being able to grow without housing prices and the cost of living getting out of control, as we’ve seen in other areas like Silicon Valley. I would argue that, in DFW, we’ve figured out a way to do all of these things quite well.”

Wyett said he can see the results every time he drives from Oklahoma to Dallas. “It’s like I’m entering the city as soon as I cross the Red River,” he said, referring to the state border about 80 miles north of downtown.

While that may be a slight exaggeration, it’s no stretch to say the region’s footprint has grown very large, very fast. And that’s not a bad thing, said Wyett.

“You’d much rather be dealing with the challenge of too much growth than to find out you’re shrinking,” he said.

Keeping the streak alive

The speakers agreed that, after 50 years of aggressive expansion, maintaining Texas’ appeal for the next 50 years won’t be easy. With the population of the DFW metroplex and Houston both on pace to surpass Chicago in the 2030s, managing growth strategically and sustainably will be a tall order.

“Every city and state says it wants to grow economically, but not all of them back it up with action,” said Clark. “To be successful, we have to keep wanting to grow, putting the right policies in place to support growth that will deliver a bright future.”

Policies and programs in question include those impacting the strength of the Texas labor force. Wyett pointed to immigration as one key issue, stating the urgent need for Congress to create a clear pathway for undocumented workers to contribute to the economy legally.

Addressing education, he noted: “There’s a higher unemployment rate among recent college graduates than those without degrees. It raises the question of whether we’re educating kids toward the right kinds of jobs that we’re going to need—jobs where people can earn a good living—like skilled trades electricians, plumbers and HVAC technicians.”

Affordable housing was another point of concern among the group.

“This area couldn’t keep up with the huge demand shock of so many people moving in over the last decade. The low-cost edge we had compared to other cities is a lot smaller than it used to be,” said Clark. He went on to note his optimism that prices may have peaked, as the Texas legislature recently passed two bills (SB) that ease restrictions on building new homes and apartments.

The ongoing business and population boom will also place enormous pressure on water and energy supplies, the panel agreed. Regarding the energy grid, Wyett said the growth of the tech industry and artificial intelligence (AI), especially, is bringing massive, power-hungry data centers to Texas.

“Texas is going to need help from all different energy sources, and it will need to invest heavily in grid improvements,” he said. “The question is, who will pay for it—the tech companies or the citizens of Texas? That’s something they’ll have to figure out.”

Rosa closed with an optimistic outlook for the state’s economic future.

“We do have challenges, but we have the resources to address them,” he said. He stressed the need for strategic collaboration between municipalities and, thinking bigger, the emergence of the “Texas Triangle” (formed by the state’s four largest cities) as an economic mega-region creating new opportunities for citizens and businesses.

“I have the job of bringing out-of-state companies here to Texas, and it feels like we’ve won a prize when we succeed,” said Rosa. “But the real trophy is when successful companies are born right out of your own dirt. When you can do that, you’ve really reached the summit of economic development.”