Consumers are worried but still spending

Meanwhile, recession risks declining from ‘less onerous’ tariff policy

The inelegant implementation of recent tariff policy has yet to hit many of the economic data points we look at. Weekly jobless claims, overall unemployment and even inflation still show a picture of a growing U.S. economy. However, when we look at consumer and business sentiment, we see a completely different picture, as these readings have declined precipitously.

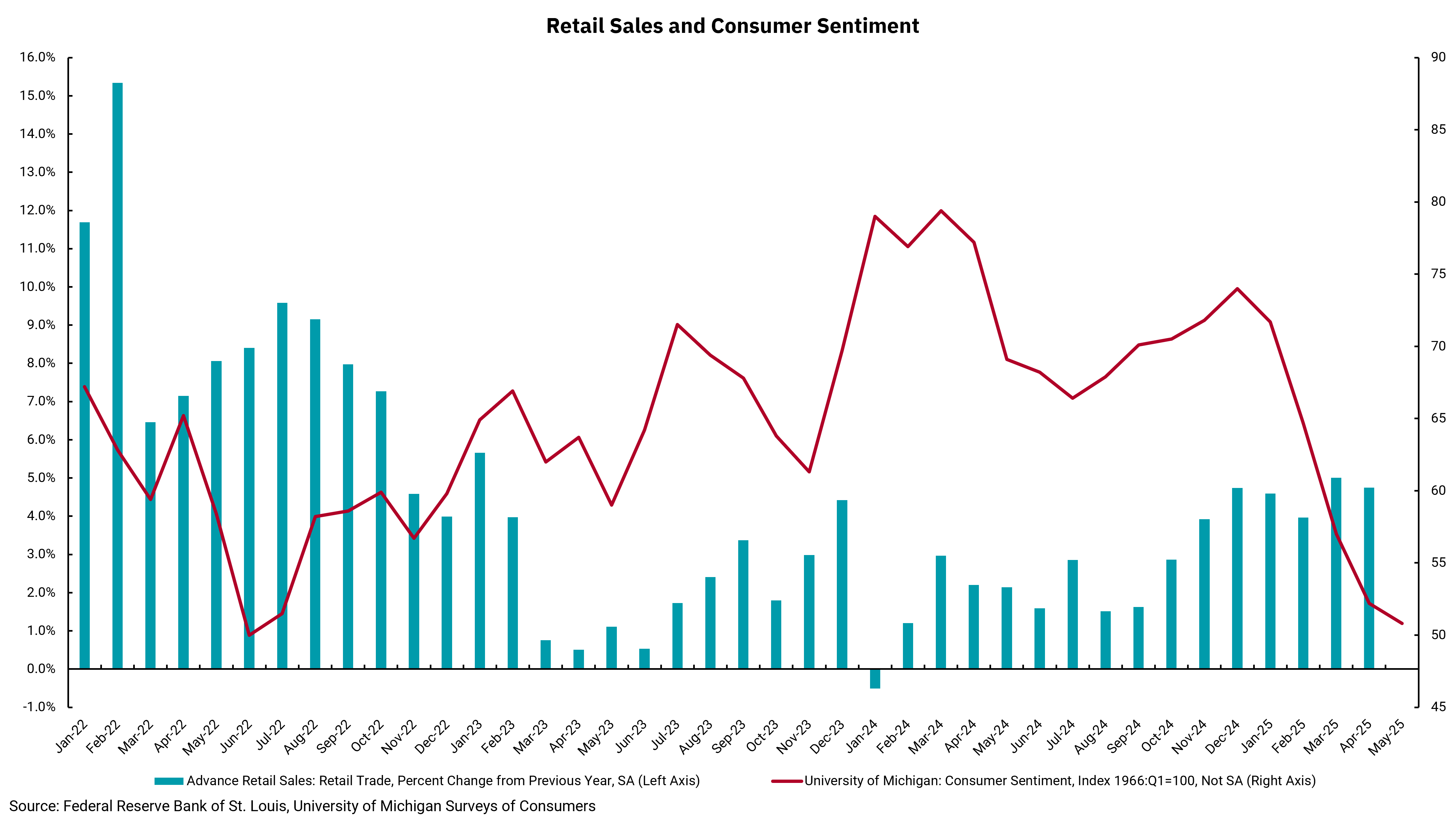

We built this chart to look at the history of consumer sentiment versus retail sales—a measure of the relationship between how people feel versus how they act, if you will. Recently, we have seen several articles indicating that the recent decrease in consumer sentiment may lead to a decline in retail activity. Since most of the U.S. economy is tied to consumer spending, this outlook added to an increasing chance of a recession.

Instead of cutting back, however, we have seen an increase in retail sales even as the latest reading on the University of Michigan's Consumer Sentiment Index fell to 50.8. This result is the lowest reading since June 2022, when the index hit 50. Interestingly, this lower reading was accompanied by another period of increasing retail sales, while better subsequent index readings were accompanied by lower retail sales growth. In the current environment, the increase in retail sales might be explained by people buying goods before tariffs are implemented, out of the expectation that prices would increase. Indeed, Walmart's recent earnings announcement expressly stated a risk of higher prices, as narrow margins at the retailer will force some pass-through of higher costs. We saw a similar reaction among car buyers as annualized auto sales spiked higher in March.

Looking backward, we did not have tariff volatility in 2022, so was it just that consumers were spending money to feel better? It can be hard to explain consumer behavior fully, but one strong theory is that, if U.S. consumers have money, they will spend it. To this end, in 2022, there were also fears of a recession as interest rates were rising rapidly, and forecasts were for economic growth to slow to even include a recession. In hindsight, the recession of 2022 never materialized, and the employment market stayed firm, providing consumers with ongoing sources of income. Ironically, it might have been the increase in spending that kept the economy moving forward.

Could consumers’ reactions in 2025 do the same? As tariff policies have become less onerous and uncertainty declines, we have seen the risks of a recession decline. We are not out of the woods yet, but U.S. consumers continue their practice of spending money if they feel good…or if they need to feel better.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)