AI infrastructure may drive growth for decades

The economic boost could help alleviate federal debt concerns but energy concerns loom

This article is part of our upcoming 2026 Annual Market Outlook. Click here to visit our outlook webpage and register for the live discussion, to be held Jan. 15, 2026 at 11am CT.

KEY POINTS

- AI infrastructure investments may drive long-term U.S. economic growth and help stabilize debt-to-GDP ratios.

- Productivity gains from AI could offset labor shortages and reshape business efficiency across industries.

- Surging energy demand from data centers threatens to become a bottleneck, making energy policy crucial for sustaining AI-driven growth.

Artificial intelligence (AI) is emerging as a strategic lever for U.S. competitiveness, with the potential to lift economic growth and help avert a looming debt crisis—but the resulting surge in power demand may mean higher energy prices and remains a risk to U.S. dominance of this new technology.

That’s the opportunity, and also the conundrum, that the U.S. faces. Still, it’s important not to underestimate the transformative effects that AI may have for consumers, businesses and the economy as a whole, experts said.

As BOK Financial® Chief Investment Officer Brian Henderson explained, “Access to reliable and abundant energy is key for continued growth, but equally important is how AI can make businesses more efficient. That’s what drives long-term competitiveness.”

This edge that AI may provide all comes down to increasing economic productivity and, in turn, economic growth both in the short- and long term, but there are still many variables at play.

“We are in the build-out phase of AI, and that is supportive of growth in the next few years,” said Matt Stephani, president of Cavanal Hill Investment Management, Inc., a subsidiary of BOKF, NA. “However, if AI truly transforms how we work, it could provide a longer-term productivity boost that might accelerate economic growth. As growth accelerates, financial markets may also see positive returns.”

Potential for greater worker productivity and efficiency

AI’s biggest economic impact likely will come from productivity gains, especially if the labor force shrinks from Baby Boomers retiring and tighter immigration policies. “Economic output is a combination of productivity and the size of your labor force,” said BOK Financial Chief Investment Strategist Steve Wyett. “If the size of the labor force is going down, the U.S. is going to need more worker productivity and AI to be as powerful as it can be.”

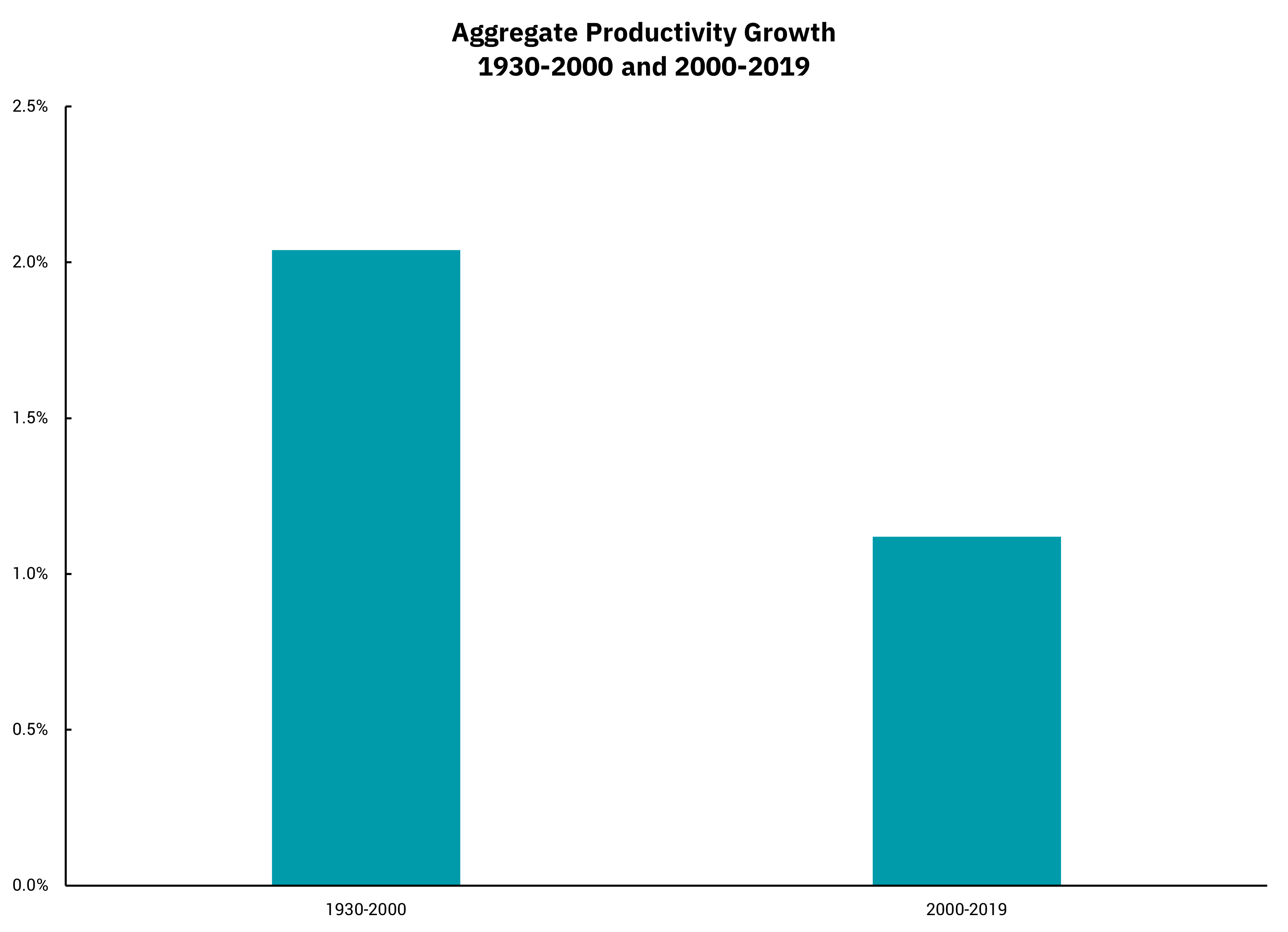

If AI does increase productivity, it would reverse the trend of slower productivity growth seen since 2000, after the gains from the technology-driven productivity boom of the 1980s and 1990s were realized.

Already, AI tools can quickly perform tasks that once required hours of human effort. Wyett gave the example of analyzing corporate filings and distilling them down to one-page summaries.

Much like the technology-driven efficiencies created by the Internet, what makes the potential benefits from AI different from other historical waves of industrialization, such as the mechanization of agriculture, is the type of workers who may be affected. With AI, even more so than was the case with the Internet, both high-earners and low-earners may be impacted, experts agreed.

Though some types of jobs may become obsolete, AI will also create greater demand for other types of roles, such as AI engineers, data center technicians and nuclear specialists for power expansion, Stephani noted.

In other words, there will be no shortage of work for people to do.

Why growth matters

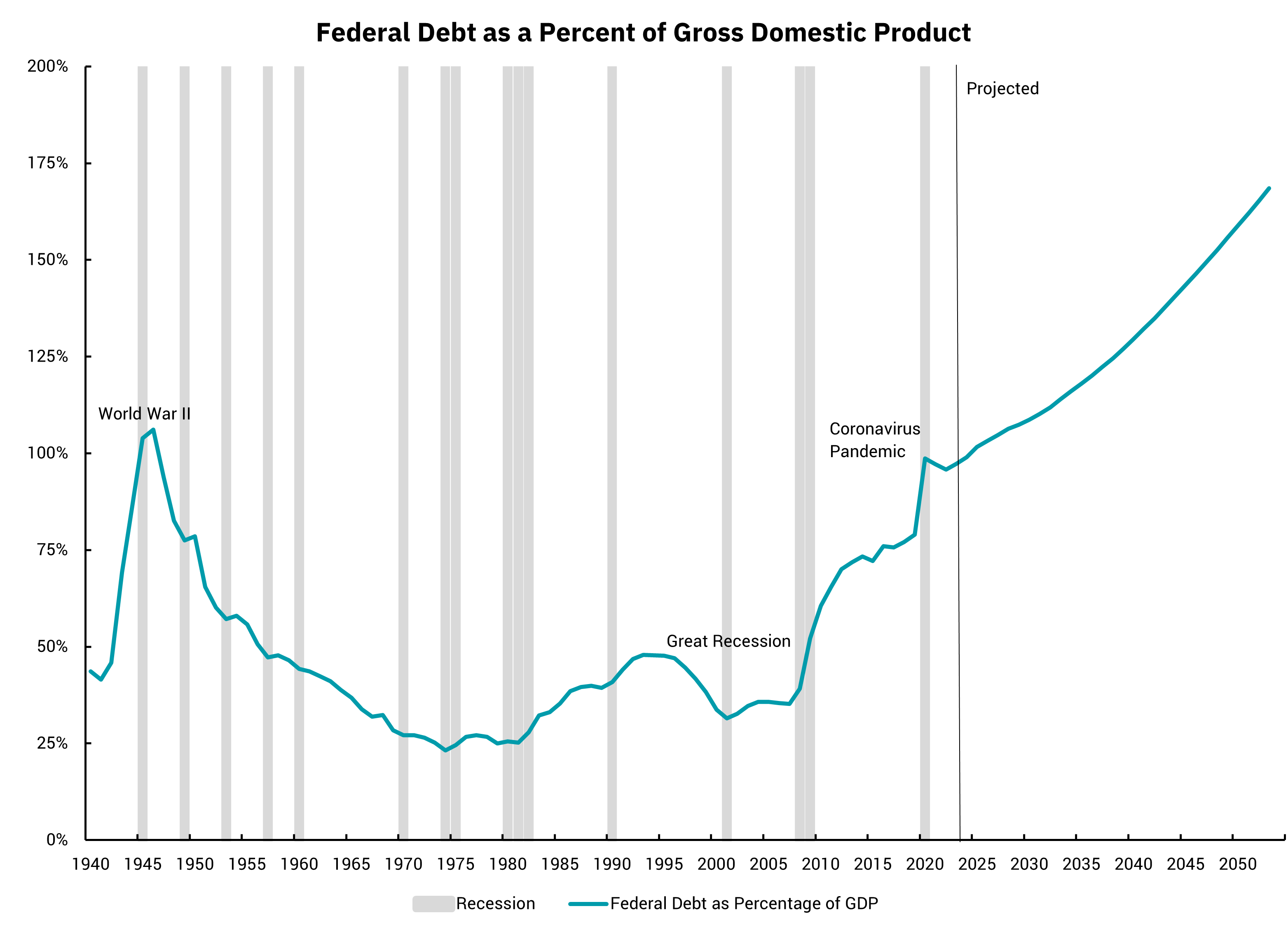

In turn, this increased economic productivity could push U.S. gross domestic product (GDP) higher, which then might change the trajectory of federal debt-to-GDP ratios. “If the United States grows at 1.6% annually, our debt-to-GDP ratio could keep exploding higher,” Stephani said. “However, if we can inflect our growth rate higher by only 50 basis points, debt-to-GDP stays flat.”

Unlike short-lived stimulus measures, investments in AI create enduring capacity—data centers, semiconductor fabs and advanced infrastructure—that could power the economy for decades, experts agreed.

Already, AI “hyperscalers” such as Amazon, Microsoft, Alphabet, Meta and Oracle are committing hundreds of billions to AI infrastructure. Meta, Amazon, Alphabet and Microsoft alone intended to spend a combined total of $320 billion on AI technologies and datacenter build-outs in 2025, based on comments from their CEOs and earnings calls, according to CNBC.

“These projects deliver a double benefit,” Stephani said. “In the near term, construction activity boosts GDP and local economies. Over the long term, the assets themselves—chip plants, data centers—become productivity engines. Think of them like you would the railroads, which were built more than 100 years ago but still provide productivity in our economy today."

So far, the primary beneficiaries of this investment in AI infrastructure have been the data centers themselves, the people cooling and putting equipment in them, and the utility power providers. The companies that will benefit from using AI, such as pharmaceuticals doing drug discovery, will be in the next wave of beneficiaries, Stephani continued.

And these benefits have the potential to be exponential, Henderson said. “Companies that integrate AI effectively will not only cut costs but also unlock entirely new revenue streams. That’s where the real competitive advantage lies,” he explained.

Energy may be the bottleneck

And yet, the bee in the ointment to all this might be power. “AI isn’t just about algorithms; it’s about pairing innovation with infrastructure. If we don’t solve the energy bottleneck, we risk falling behind globally,” Henderson said.

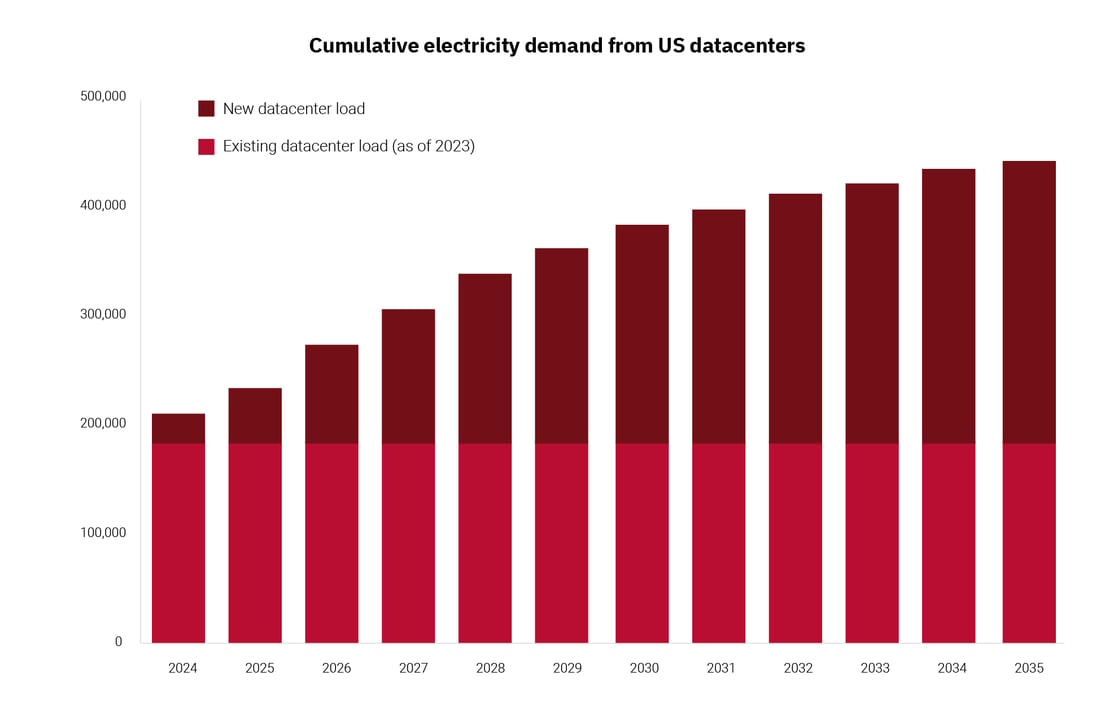

AI’s infrastructure demands are immense, and the U.S. grid is already strained. “Data centers come online quicker than power capacity can be brought online,” Wyett said. “The grid has not had a lot of new investment.”

Electricity demand, flat for two decades, is now surging and bringing up prices with it. Since 2022, the rise of retail energy prices has outpaced broader inflation, according to the U.S. Energy Information Administration (EIA).

Additionally, this increased demand for power will likely put extra strain on the power grid. Without upgrades, regions like Arizona, Texas and the mid-Atlantic could face brownouts during peak periods, Wyett said.

For these reasons, U.S. energy policy will be crucial in determining the path forward, experts agreed. As Henderson explained, “Energy isn’t just a cost factor; it’s the foundation for AI growth. Without reliable, affordable power, all the investment in data centers and chips won’t deliver the competitive edge we’re aiming for.”