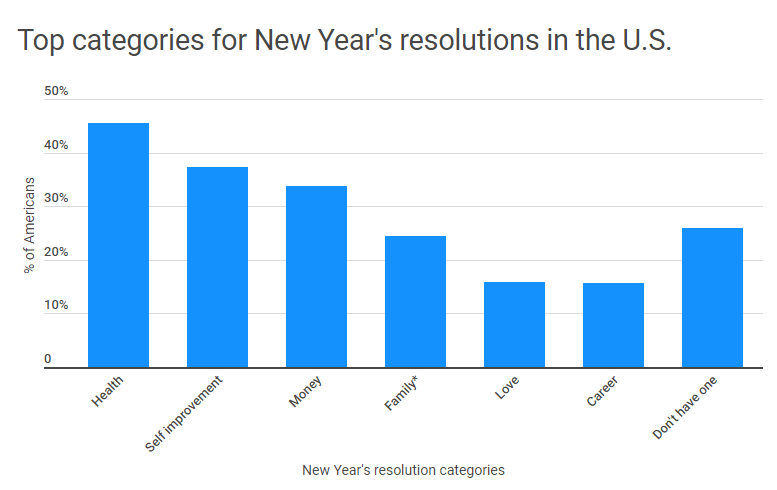

Every year, January offers up a blank slate. An estimated 188.9 million adult Americans made New Year's resolutions for 2021 with health, self-improvement and money being the top focus areas, according to a Finder.com survey.

Turning over the calendar year is a logical time to make a habit of checking in on your financial wellbeing. Whether you're staring down a mountain of debt or just need an annual financial check-up, here are 10 tips to help you take better care of your finances.

1. Create or update your budget.

The pandemic changed many things about individual and family budgets. Have you revisited yours recently? If not, one method is to build a 50/30/20 budget—50% to must-haves, 20% to savings and debt repayment (including your emergency fund) and 30% toward wants.

2. Start small to pay off debt.

Starting with debt repayment will allow you to feel more in control of your finances, but how do you make a dent? "Start with achievable goals and understand it will take time to pay it off," recommends Brandy Marion, Institutional Wealth education manager at BOK Financial®.

She suggests a three-year roadmap to pay down debt, using automatic payments if possible.

3. Set savings goals.

One in four Americans can't cover an emergency expense, a statistic worsened by the pandemic. Once you've got your debt repayment plan under control, Marion recommends establishing a fund specific to emergencies because "if something comes up and you don't have an emergency fund, you're going to make bad decisions."

4. Ensure tax documents are up to date.

Review your address and W-2 information in your employer system. This will ensure your W-2 gets to the right location—on time. In addition, double-check your tax withholding details.

5. Review retirement contributions.

If you are contributing to a 401(k) with an employer match, are you getting the full benefit? For 2022, the IRS limit for individual 401(K) contributions will increase by $1,000 to $20,500, or $27,000 if you're 50 and over. Annual contribution limits for individual retirement accounts (IRAs) are unchanged at $6,000 per year.

"It's a good idea to check your contributions and allocations at least once a year to ensure they still align with your goals," said Kimberly Bridges, director of financial planning at BOK Financial.

6. Optimize your HSA contributions.

Health savings account (HSA) contribution limits have increased as well. Individuals with coverage under a high deductible health plan can contribute up to $3,650 for the year to their HSA—up $50 from 2021, and families can contribute up to $7,300—up $100 from 2021.

"If you have access to an HSA, it's a great savings tool," said Bridges. "Medical expenses can add up quickly and having that pool of funds available to cover insurance deductibles, co-payments and out–of-pocket expenses is a nice perk to a high deductible plan. Many clients also choose to save those funds for medical expenses in retirement, opting to pay current expenses with after-tax dollars in order to benefit from tax-free compound earnings in their HSA."

7. Prepare for the return of student loan payments.

If you have student loans, be aware that the student loan freeze that began in March 2020 expires on Jan. 31, 2022. That means your repayment schedule will start again in February—don't miss that payment.

8. Check on your education savings.

If you're on the other end of the spectrum and saving for future educational expenses, many states offer a deduction or credit for 529 plan contributions with a Dec. 31 deadline. There are no annual contribution limits for 529 plans, but gift tax exclusions do come into play. In addition, a provision of the SECURE Act allows 529 plan beneficiaries to repay up to $10,000 in student loans using 529 funds under some circumstances.

9. Check your beneficiaries.

It's a good idea to check your beneficiary designations once a year, especially if you have a life event.

10. Create a will.

The pandemic has heightened awareness of the need for a will, especially for young people, but only one-third of Americans have prepared estate planning documents, according to a 2021 Wills and Estate Planning Study from Caring.com. In addition to preparing a will, it's important to review estate plan documents on a regular basis. The No. 1 reason survey respondents gave for not having a will is not getting around to it.

"Anyone who has had to fill the unfortunate role of settling a loved one's estate understands the value of having a valid will and other estate planning documents in place," said Bridges. "Making difficult decisions about what should happen with the property (or the children) of the deceased is compounded by the grief you are experiencing by the loss of your loved one. Having an estate plan in place is truly the greatest gift you can give your family."

Whether all of these topics apply to you or not, a fresh new year is a great time to be sure your finances are in order. Where will you begin?

Information in this article should not be construed as legal or tax advice and is offered for general informational purposes only. Links to other sources of information are provided only for the convenience of the reader and should not be considered a recommendation or endorsement.