Debt: the good, the bad and the ugly

Knowing the difference between healthy and unhealthy debt can help build wealth

Think of debt as the ultimate double-edged sword.

Some debt can improve your life, like buying a new house, or growing your overall net worth. Other kinds can send you into a financial spiral, such as high-interest credit card debt. Learning how to differentiate between healthy and unhealthy debt early helps set the path for a solid financial foundation—especially for parents interested in helping teens understand how debt works before their children leave home.

But it's never too late to learn.

"At its basic level, all debt is the same. You borrow money to buy things in the present and pay it back in the future," said Josh Denton, BOK Financial® senior consumer product manager lead. "But the type and amount of debt you take on can have positive or negative consequences on your financial life."

Healthy vs unhealthy debt

Denton recommends categorizing your current debt as healthy or unhealthy. Then, work to eliminate the unhealthy debt and only take on new healthy debt.

Healthy debt builds your net worth or increases your overall lifetime earnings.

"Healthy debt is very dependent on the individual," Denton said. "Any debt you take on should be manageable and shouldn't cost you too much. Don't get into a situation where you are overleveraged, even if that type of debt is considered healthy."

Overleveraging occurs when someone has borrowed too much money and is unable to make all of their payments.

Meanwhile, an example of unhealthy debt is money borrowed to purchase rapidly depreciating assets.

Avoid payday or high-interest loans at all costs, Denton cautions. Often referred to as predatory lending, these loans can lead to a debt trap that is hard to get out of and may deteriorate your credit score.

Establish good credit

On the flipside, maintaining healthy debt and making regular payments can help increase your credit score.

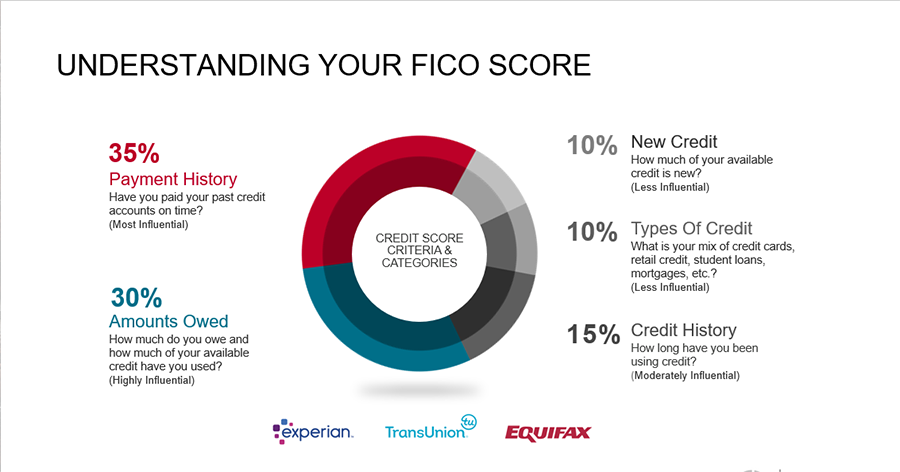

Having consistent, on-time payments is paramount, Denton noted. “Even one default or late payment can be detrimental to your score.” The amount you owe and your payment history make up 65% of your FICO score.

Having a good credit score (aka FICO score) makes you eligible for better interest rates on big life purchases like a car or home. A bad credit score could mean paying thousands of dollars more for the same thing.

"Credit affects more than just our ability to borrow. It can affect your chance of getting a job, an apartment and how much you’ll pay for auto insurance"- Brandy Marion, BOK Financial retirement plans education manager

Building good credit can be the ultimate catch-22. Having no credit history often means you can't get a loan, which would help you build your credit history.

Loans aren't the only way to build credit, however. For instance, credit scores sometimes consider rent and utility payments.

Credit cards

One of the top sources of debt after mortgages is credit cards—and they can be healthy or unhealthy, depending on how well you manage them.

To help your teen build credit, Marion said a parent with good credit can add them as an authorized user on their credit card account or, if they are at least 18, they can apply for a secured credit card.

"Having a credit card can help build a good credit score, but only if you always make your payments on time and pay off your credit card balance each month to keep a low credit utilization ratio," Marion explained.

Denton agreed, "Credit card debt can easily cross the line from acceptable debt to unhealthy debt, so tread lightly."

Paying off your card each month will prevent you from accumulating large amounts of debt at high interest rates—and will allow you to put money toward other goals, like paying down student loans or saving for a down payment on a home.

Student loans

The cost of college has more than doubled since 2000, and consequently millions of people rely on student loans to cover those expenses. However, students should be cautious with the amount of student loans they take out.

"You should only borrow what your estimated future earnings will allow you to repay," said Marion. "In other words, you may want to avoid going to Harvard and getting a basket weaving degree."

She also suggests (if possible) to start paying off your loans while you're still in school to avoid letting the interest become mammoth, and to enroll in auto pay, which will sometimes lower the interest rate on the loan.

Build and use debt to your advantage

While it's generally advisable to avoid debt, there are certain circumstances when taking on debt can help you build wealth. Owning a home is one of the most accessible ways to build generational wealth because real estate is an asset class that appreciates in value over time.

"Homeownership is a dream for most Americans, but it's rare to be able to buy a house outright, so instead you'll need to take on debt as a mortgage," Denton said.

Many house hunters think you need 15-20% for a down payment, but that's not always the case. For first-time homebuyers, many lenders will accept a smaller down payment, but whatever amount you can put down will lower the amount of debt you take on with a mortgage.

"If you have debt, it will count against how much you can borrow," said Marion. "But on the flip side, if you have good credit, you'll be extended better rates when you apply for a mortgage."

Taking on any type of debt requires planning and consideration. Marion and Denton suggest only taking on debt you know you can pay back. One additional life skill parents can teach their teens or young adult children is to shop around for the best interest rates and loan terms, and to consult a financial expert before making significant financial decisions.