How to prepare for lower rates

The Fed is expected to cut rates slowly this year—but you should be prepared for all scenarios

There was little surprise on Wednesday when the Federal Reserve announced that it would hold rates where they’ve been since July. The Fed also is still projecting that there will be a total of three rate cuts this year—though it lowered its rate-cut projection for 2025 by one. However, there are still potential risks ahead and a “soft landing” is by no means a certainty, cautioned BOK Financial® Chief Investment Officer Brian Henderson.

The Federal Open Market Committee’s decision came two weeks after Fed Chair Jerome Powell’s semiannual testimony to Congress, in which he reaffirmed that the Fed likely will not hike rates again this year. This means that the target Federal Funds rate is probably at its peak at a range of 5.25% to 5.5%, Henderson said.

The Fed raised this figure, which is the overnight interest rate that banks charge each other to borrow money, at a fast clip—by 525 basis points, or 5.25%—between March 2022 and July 2023.

Is a recession off the table?

On one hand, the fact that the U.S. economy has gone through one of the fastest rate-hiking cycles that we’ve ever seen without going into a recession is a feather in the Fed’s cap. “In the previous six hiking cycles, dating back to 1989, all but one either led to a recession pretty quickly or an event that made the Fed reverse course,” Henderson said.

Today, instead of a recession, the economy has proved surprisingly resilient to the rate hikes. “The S&P 500 is up, the U.S. dollar has been depreciating against the yen and euro, and credit spreads are the lowest we’ve seen in 10 years,” Henderson said. All these signs point to easing financial conditions. Moreover, the current economic strength doesn’t seem to be a temporary blip, either: based on the Federal Reserve Bank of Chicago’s National Financial Conditions Index (NFCI), financial conditions have been improving since October 2023.

So, what makes this rate-hiking cycle different than the five that quickly led to a recession?

One factor has been the large number of open jobs, which was as high as two openings per every unemployed person in mid-2022. Rather than laying off existing employees, businesses were able to cut open positions, which helped prevent the spike in unemployment that’s normally seen when the Fed raises rates to slow the economy, Henderson explained.

Other factors include the recent heavy government spending and federal laws such as the Infrastructure Investment and Jobs Act, as well as the CHIPS and Science Act, he said. “These laws supported the most interest rate sensitive sectors of the economy, mainly construction.”

Consumers, businesses probably won’t see giant decline in debt costs

Yet this good news may come as a surprise to those who have been struggling with paying higher interest rates on debt, Henderson acknowledged. “Having said all that, the absolute rate that individuals, corporations and governments are having to borrow at is high; it’s restrictive,” he said.

Indeed, as of Mar. 14, the average credit card interest rate was 27.89%, according to Forbes Advisor’s weekly credit card rates report. That figure is, of course, significantly higher than the Federal Funds rate.

When the Fed starts to lower the target range for the Federal Funds rate, interest rates paid by consumers and businesses likely will go down, too, as the Federal Funds rate target, along with the Fed’s communications, indirectly affects those other rates, Henderson noted.

Meanwhile, the Fed’s cuts probably will be in small increments, likely of 25 basis points each (one-quarter of a percentage point), and spaced out over time, he continued.

“They will be letting up on the brake pedal a little bit, but not taking their foot off the brake completely.”- Brian Henderson, BOK Financial chief investment officer

“Powell doesn't want to be in the ‘Burns Camp,’” he said, referring to former Fed Chair Arthur F. Burns, who served as chair from 1970 to 1978. “Then, the Fed cut interest rates too soon and by too much, which set the stage for several different additional waves of inflation.”

How to prepare for rate cuts

Even if the Fed does take this slow and careful approach to rate cuts, the move will still lower the short-term interest rates paid on some savings vehicles such as money market accounts, certificates of deposit (CD) and savings accounts, as well as the yields paid on some money market funds.

“If you have balances in interesting-bearing cash, money market funds and savings accounts, you want to be thinking about extending those maturities,” Henderson said. “But you also need to keep some maturities short because what happens if everybody’s wrong and rates go up?”

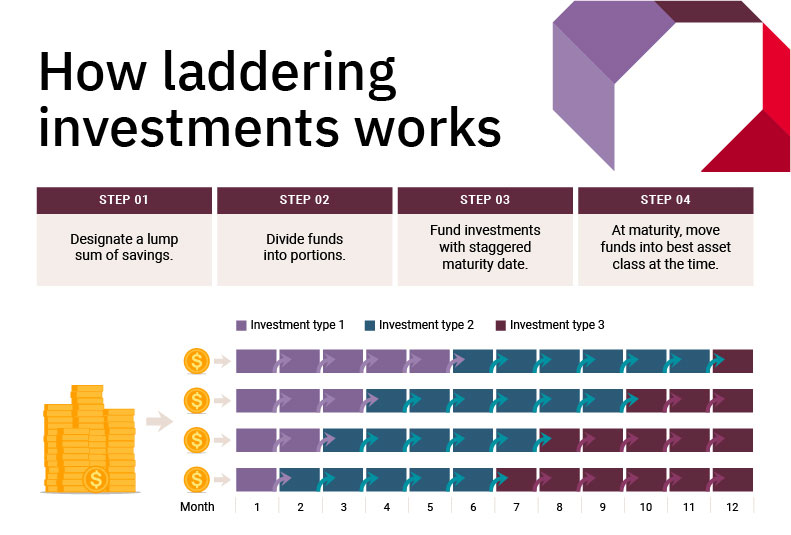

One option is a laddered approach in which your investments are spread evenly across a desired time frame. As each portion matures, you may direct the proceeds into the asset class that fits best at that time

This laddered approach, alongside having a diversified portfolio in general, can help you prepare for sudden changes in Fed policy, Henderson said. For instance, sometimes an exogenous event occurs as the Fed is cutting rates, forcing them to suddenly cut more rapidly. This happened when the 2008 Financial Crisis occurred and more recently with the onset of the COVID-19 pandemic.

The bottom line is that it’s important to be ready for everything, Henderson said. “Economic activity can weaken very quickly. The Fed needs to be nimble: they currently can afford to be patient given the still-tight labor market and strong gross domestic product (GDP) data—but be on guard for sudden changes.”